What Bills Can You Pay with a Credit Card?

Published on: 02/01/2023

Bills commonly paid with a credit card include internet, phone, cable TV and streaming services since these providers don’t typically charge a convenience fee.

While paying your bills with a credit card can offer the convenience of paying instantly or setting up automatic payments and earning you potential perks (you often have a grace period and may even earn rewards points), it may not always make sense to do so. For starters, not all businesses allow you to pay with a credit card. When some companies do allow it, they may charge you a convenience fee or surcharge because both credit card and debit card transactions cost them money to process.[1]

So even if you have the option to pay your bills with a credit card, you may want to consider the potential downsides as well — such as if the company charges high fees, if you already have significant credit card debt or if you have concerns about paying the balance off by the due date.[2]

This article provides guidance on which bills you can pay by credit card and what to consider when choosing between credit cards and other bill payment methods.

What bills should you pay with a credit card?

Some merchants may consider credit cards a nonstandard way to pay your bills, and credit card payments cost companies money to process. That’s why you may see a convenience fee or surcharge when you opt to pay by card instead of cash or check.[1] However, if it is commonplace to pay by credit card in a certain industry or business (such as everyday purchases in grocery stores), the company may not pass the fee on to you.

Service providers may allow you to pay bills with a credit card, but any of them could tack on convenience fees or other surcharges to offset their costs in the transaction. If you choose to pay rent using a credit card, for example, you could incur an extra fee for the payment to be processed through a third-party service.[3] If you pay $900 in rent, a 2.5% convenience fee for using a credit card would make your monthly payment $922.50.

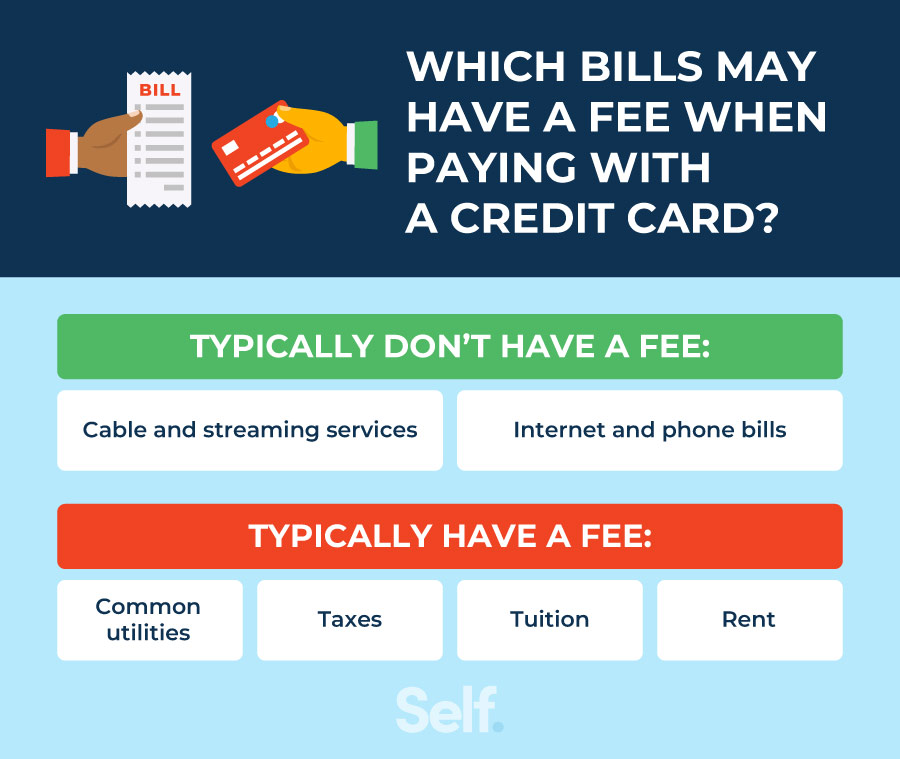

Bills that typically don’t have convenience fees for using a credit card

- Cable and streaming services: Cable providers and streaming services typically don’t charge additional fees, making them ideal to pay with a credit card. Plus, setting up automatic bill pay makes it easy to never forget a payment.

- Internet and phone bills: Like cable and streaming companies, internet and phone providers don’t usually charge a fee for using a credit card. Some credit cards may also include theft and damage protection for your cell phone or offer extra points on phone bills, potentially making it more than worth your while to pay with a credit card.

[4]

Bills that typically do have convenience fees for using a credit card

- Common utilities: They will likely pass these charges onto the consumer. They may charge a set amount (such as $1.50 per transaction) or a percentage of your total bill. Balancing how much these fees cost against what you receive in benefits — from the convenience of autopay to any cash back rewards — will help you decide if you should use a credit card for your utility bills.[5]

- Taxes: Paying taxes with cash back credit cards or credit cards with other perks may earn you rewards, but it doesn’t come without a cost. In fact, you’ll likely have to pay a percentage of your total tax bill — typically 2% to 4% — making this payment method less ideal.[6]

- Rent: Paying rent with a credit card usually requires the use of a third-party company, which may have an additional processing fee of 2% to 3% of the transaction amount. Again, unless you have decided that the benefits outweigh the drawbacks, you may not want to use a credit card to pay your rent.[3]

- Tuition: Much like taxes and rent, paying tuition with a credit card usually comes with a pretty steep convenience fee. For example, one third-party company, Plastiq, charges 2.85% of the transaction amount, so you might consider other payment methods than paying tuition with a credit card.[7]

Bills that may not allow you to pay with a credit card

- Mortgages: Since lenders typically don’t accept direct credit card payments, you may find it difficult to pay your mortgage with a card. Like paying your rent, you would likely have to use a third-party service that could end up costing you an additional 2% to 3%.[3], [8]

- Loans: If you want to pay off a portion of your auto loan, private student loan, or personal loan with a credit card, you should contact the financial institution. Some lenders permit credit cards for loan payments, while others do not — or cannot by law.[9]

When should you consider paying bills with a credit card?

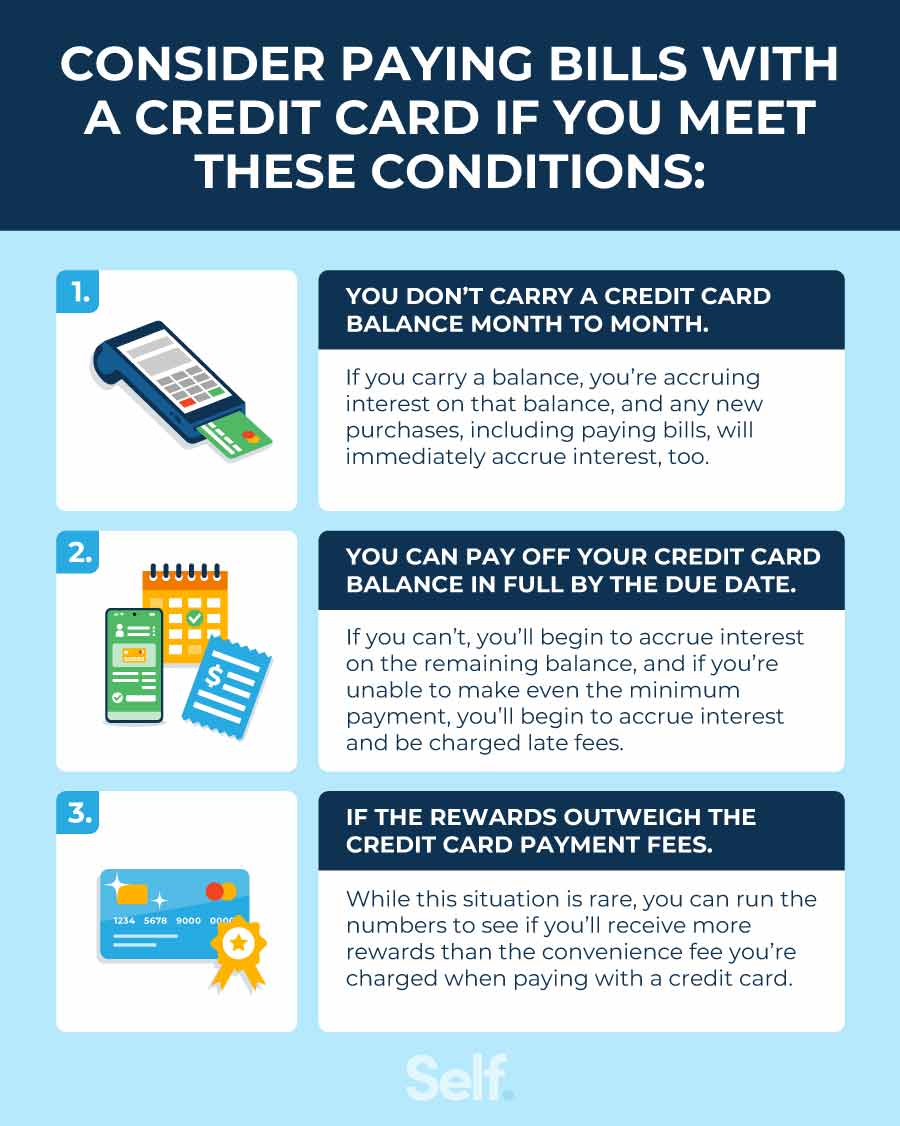

Depending on your unique financial situation and the specific bill involved, it may make sense to use a credit card. Below, we cover some common situations where you would consider using your credit card over other forms of payment. You may find the following guidelines useful when evaluating the best payment method for paying bills.

If you can pay off your credit card balance in full by the due date

The best credit cards to use when paying bills are ones on which you don’t carry a balance and also pay the balance in full by the due date. Then you can take advantage of rewards and other perks without the drawbacks of paying interest.

Paying off your balance in full allows you to avoid credit card interest charges and lowers your credit utilization ratio (CUR) (the revolving debt you owe divided by the total amount of your revolving credit limits).[10]

Before paying a bill with a credit card, make sure that you can afford to pay everything you owe by the due date. If you can’t even pay the minimum payment, you’ll be charged late fees in addition to the interest on the balance.

If the rewards outweigh the credit card payment fees

Depending on your card’s program, putting a large bill on a credit card may help you gain rewards points quickly, especially with premium cards, and may pay off in cash back if you pay your balance by the due date (thereby avoiding additional charges).[3] Before deciding to pay a bill with a credit card solely for the perks, remember to consider fees, interest rates and other charges to make sure it makes sense.

When should you consider paying bills with another form of payment?

In other situations, it may make more sense to select another form of payment. The following considerations may help you decide when using a credit card to pay your monthly bills may not be the best choice.

If you can’t pay the minimum or full balance by the due date

When you don’t pay off your credit card bill in full each month, interest charges can add up fast. Furthermore, carrying a large balance can impact your CUR, eventually affecting your credit. While you may have a bill that’s so large you can only afford to put it on a credit card, make sure that you can at least make the minimum monthly payment. Failing to do so can result in late fees, impact your payment history and potentially impact your credit score.[6]

If the fees outweigh the benefits of using a credit card

Remember to calculate convenience fees and surcharges when deciding if it makes sense to use a credit card. Any rewards or cash back you may earn can quickly disappear. If you get 1% cash back on a $1,000 rental payment made by credit card, for example, you receive a $10 reward. If your landlord charges a $15 convenience fee, however, you actually end up losing $5 if you pay with a card. In this case, you may spend smarter by choosing another form of payment.

If you have high credit card debt

If you already have high credit card debt, paying bills with a credit card might not be the best decision. You may want to avoid taking on additional debt until you get a better handle on your personal finances by making a budget, negotiating with lenders, talking to a credit counselor and/or working down your debt before adding another bill.

Look at your monthly spending and bills, determine which budgeting categories you’re spending too much in, separate necessary from unnecessary expenses and see if you can make cuts to reduce your debt load. Taking stock of your bottom line can help you weigh the pros and cons of using a credit card to pay your bills.[2], [11]

Budget your expenses

Creating a budget can help you avoid taking on additional debt or simply get yourself into a better financial situation. If you have already accumulated a fair amount of debt, the following suggestions may help get your finances back on track.

- List off all of your debts and monthly expenses. An important first step to getting a handle on your finances is to have a good picture of where your money goes each month.

- Create an income-based budget to categorize your expenses. A basic budget can help you identify where to cut back and establish a payoff plan for debts. Setting monthly spending goals may enable you to use any extra cash to pay down balances on your credit cards or other debts.

- Find a debt repayment plan that works for you. The debt snowball method can help you pay down your debts by taking them one at a time. After making the minimum payment on all your accounts each month, any extra cash goes towards paying off the card with the lowest balance. The debt avalanche method offers a similar approach, but it has you start with the card with the highest interest rates.

- Have a discussion with your credit card issuer or a credit counselor for potential relief. Credit card companies may agree to a forbearance if you’re struggling to make payments. While this depends on each person’s unique situation, if you are granted a forbearance, you get some extra time to right yourself financially. A reputable credit counseling agency may also offer guidance on how to navigate your financial journey.

[2]

Although you can pay several types of bills with a credit card, that doesn’t always mean you should. Any smart financial decision involves weighing the pros and cons of each option. If you need help getting on the right path, Self’s products may help you save money, build credit and establish positive financial habits.

Sources

- U.S. News & World Report. “What Are Credit Card Convenience Fees?” https://money.usnews.com/credit-cards/articles/what-are-credit-card-convenience-fees. Accessed on September 29, 2022.

- MyFICO.com. “What to Do if You're Struggling with Credit Card Debt,” https://www.myfico.com/credit-education/blog/struggling-credit-card-debt. Accessed on September 29, 2022.

- U.S. News & World Report. “Can You Pay Your Rent or Mortgage With a Credit Card?” https://money.usnews.com/credit-cards/articles/can-you-pay-your-rent-or-mortgage-with-a-credit-card. Accessed on September 29, 2022.

- Fifth Third Bank. “5 Monthly Expenses to Put on Your Credit Card,” https://www.53.com/content/fifth-third/en/financial-insights/personal/credit-cards/5-monthly-expenses-to-put-on-your-credit-card.html. Accessed on September 29, 2022.

- Creditcards.com. “Why utilities charge convenience fees to pay by credit card,” https://www.creditcards.com/education/utilities-payments-charge-credit-card-convenience-fees/. Accessed on September 29, 2022.

- CNBC. “Can you pay taxes with a credit card—and should you?” https://www.cnbc.com/select/can-you-pay-taxes-with-a-credit-card. Accessed on September 29, 2022.

- Plastiq. “The Plastiq Fee,” https://support.plastiq.com/s/article/the-plastiq-fee. Accessed on September 29, 2022.

- Forbes. “How To Pay Your Mortgage With A Credit Card,” https://www.forbes.com/advisor/credit-cards/how-to-pay-your-mortgage-with-a-credit-card/. Accessed on September 29, 2022.

- Chase. “Can you pay off a loan with a credit card?” chase.com/personal/credit-cards/education/basics/can-you-pay-off-a-loan-with-a-credit-card. Accessed on September 29, 2022.

- TransUnion. “Paying the Balance vs. Paying the Minimum on a Credit Card,” https://www.transunion.com/blog/debt-management/credit-card-101-paying-the-balance-vs-paying-the-minimum. Accessed on September 29, 2022.

- Experian. “What Happens if You Only Pay the Minimum on Your Credit Card?” https://www.experian.com/blogs/ask-experian/what-happens-if-you-only-pay-the-minimum-amount-due/. Accessed on September 29, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).