Should I Pay Off Debt or Save Money First?

Published on: 08/03/2022

Financial advisors are quick to tell you that it’s a good idea to pay off debt, but they’ll also say it’s also a good idea to save money. The question is: Which should you pursue first?

Ultimately, the best decision is going to be whatever works for your unique personal financial situation and financial goals. That said, we have some tips and strategies that can help you do both by making a few changes and thinking smarter about money management.

Table of contents

- Save for an emergency fund

- Pay off high-interest debt

- Consider your individual situation and goals

- Pros of paying off debt first

- Pros of saving money first

- Should I use my savings to pay off debt?

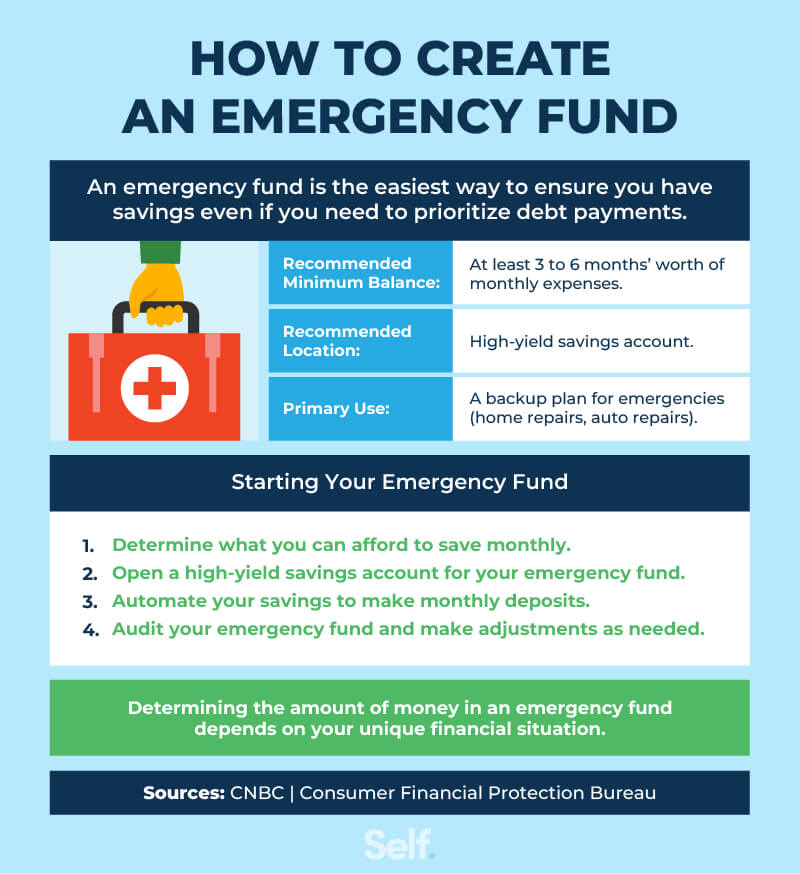

1. Save for an emergency fund

Expect the unexpected, or so the saying goes. That’s what an emergency fund is all about: It’s a place to build a cash reserve for crises you won’t see coming but are likely to face at some point. You just don’t know what form they’ll take or when they’ll occur, so it’s best to be ready at a moment’s notice.

Experts advise having at least three to six months’ worth of expenses saved in your emergency fund. But that may not always be possible. America Saves recommends starting small by saving $500 for your emergency fund. From there, you can add funds as your budget allows.[1]

However much you’re able to save for a rainy day, it’s a good idea to put it in a savings account that’s separate from your regular savings or checking account so you aren’t tempted to tap it for everyday expenses or impulse purchases.

2. Pay off high-interest debt

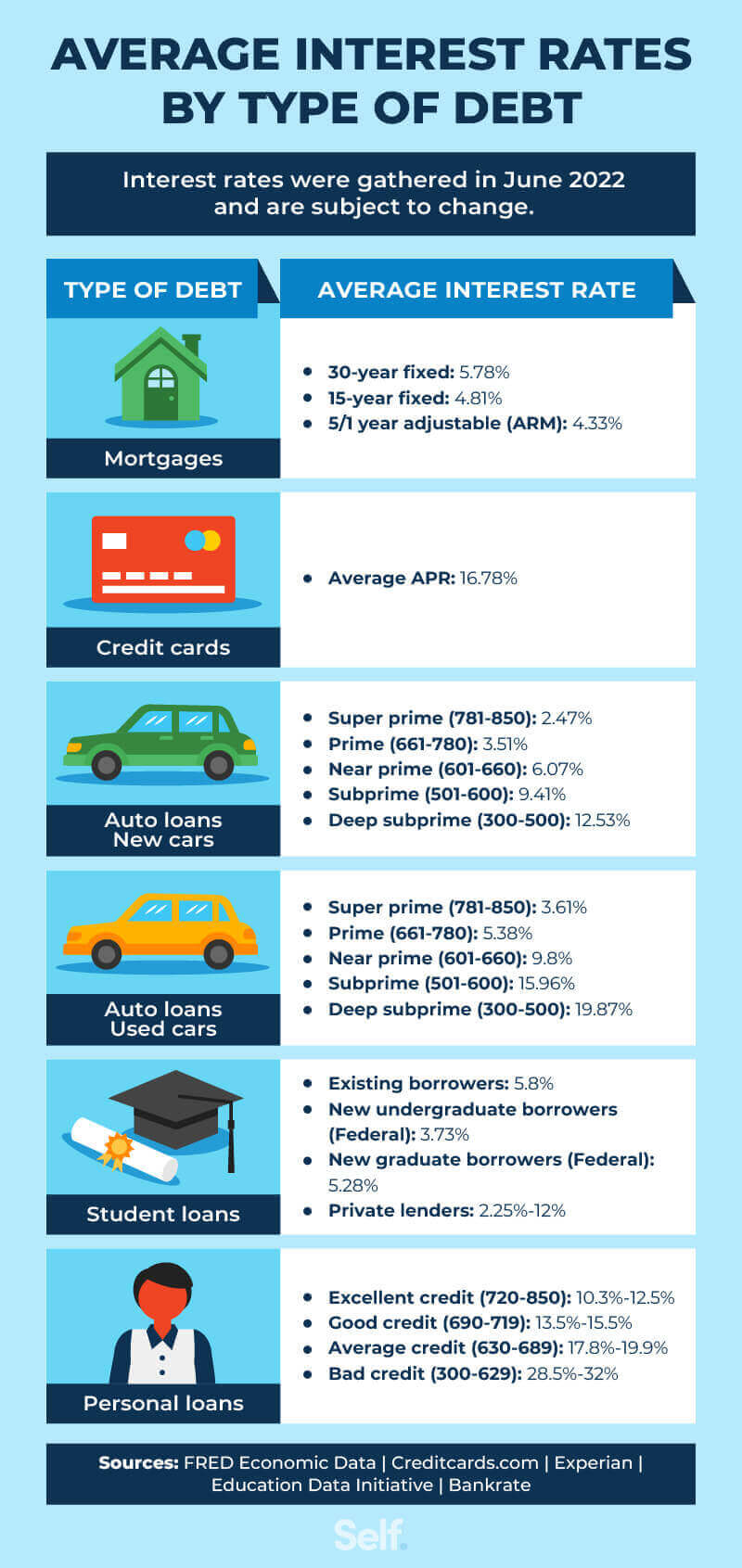

What type of debt are you facing? It’s an important question because not all debt is created equal. High-interest debt such as a payday loan will cost you a lot more than low-interest obligations like many federal student loans. If interest charges are compounding — and you’re paying interest on the interest you already owe — it’s even worse.

Suppose you had a $2,000 credit card balance on a 15% APR card, and normally paid $40 a month. By the time it’s paid off, you’ll have paid $1,158 worth of credit card interest — more than half the original balance! That’s why it’s important to pay more than the minimum balance, if you can, when you make monthly payments.

Beverly Harzog, the credit expert at U.S. News & World Report, calls credit card debt “toxic debt.”[2] It tends to carry a much higher interest rate than, say, mortgage debt – and you won’t end up with a house at the end of the repayment to your card issuer. The longer you delay credit card payoff, the harder it will be.

“If you only pay the minimum, the debt gets bigger and bigger,” says Harzog, author of *The Debt Escape Plan*.

In the example above, suppose you raised the minimum payments from $40 to a higher figure:

- At $75 a month, you’d wind up paying $448 in total interest.

- At $100 a month, you’d pay $315 in total interest.

- At $150 a month, your total interest would be $201.

- At $200 a month, it would be down to $150.

Here are some high-interest loans to target when paying down debt:

- Payday loans: According to the Federal Trade Commission, a typical two-week payday loan with a $15 fee for $100 borrowed can translate to an annual percentage rate of 391%.[3] And it could be even more: In Texas in 2021, the APR for a $300 two week payday loan could go as high as 664%, more than 40 times the average credit card interest rate.[4]

- Car title loans: You’ll pay an average finance fee of 25% on the amount you borrow, which translates into an APR of about 300%.[3] It would cost you more if you roll over the loan, and you could lose your vehicle (even if you’ve made partial payments) because it acts as collateral.

- Personal loans: The interest rates on personal loans vary, but can be as high as 36%.[5]

- Credit cards: With poor credit, a high-interest credit card could carry interest charges as high as 30% APR.[5] You can, however, get much better terms, depending largely upon your credit score. The average charged by lenders is closer to 16%.[4]

3. Consider your individual situation and goals

Deciding whether to pursue debt payoffs or your savings goals first can be tricky, and it’s not necessarily an either-or proposition. If you want to know how to pay off debt and save money, balancing these two priorities will depend on a number of factors, including but not limited to:

- The size of your debt.

- How much you want to save for retirement and where you are in the process.

- How much emergency savings you need.

- The effects of compound interest on your debt and investments.

Here are a few tips you can use to reduce your debt and maximize your savings.

Tips for paying off debt

- Debt snowball method: Under the debt snowball method, you pay off your smallest debt first while making minimum payments on the rest. When the first loan is paid off, you roll the payments you were making on that debt into the next-smallest, continuing the process until you’re debt-free.

- Debt avalanche method: This approach involves targeting your loan with the highest interest rate first, while making minimum payments on the rest. That way, you’ll avoid paying extra money in the form of interest.

- Debt consolidation: Consolidating your debt into a single loan can simplify your finances and make it easier to keep track of payments. However, it’s important to check interest rates to be sure you aren’t paying more for the consolidated loan than you have been for the individual loans it’s replacing; it’s also important to consider how this might affect your credit score, specifically the age of your credit history and your credit mix.

- Credit counseling: A nonprofit credit counselor can create a budget and debt-management plan that can help you get out of debt. Credit counselors can also help with debt consolidation, as well as with strategies to keep you out of debt in the future.

- Refinance loans: You can tap into your home’s equity to pay off debt by refinancing. This can help you save money on interest because home equity loans typically carry much lower interest rates than other types of loans and lines of credit, such as credit cards.

Tips for saving money

Saving money is important, even if you have to prioritize debt repayment. The longer you wait to start contributing to a retirement plan, the more money you’ll have to put away in order to continue your standard of living once you retire; and if you don’t have an emergency fund in place, you could be scrambling when you’re hit with a crisis.

- Keep a monthly budget: Do an inventory of your finances to find out how much you’re spending on various categories (housing, food, utilities, transportation, recreation, etc.) each month and see where you can cut back. Budgeting apps and money-saving apps can help.

- Try a money saving challenge: Put your loose change in a jar or round up your purchases and put the difference in savings. Cut out all excess spending beyond basic expenses for a month. Or save money on transportation by riding a bike or carpooling.

- Consider a high-yield savings account: High-yield savings accounts can carry annual percentage yields 10 to 25 times as high as typical savings accounts. They may be subject to certain restrictions, including minimum deposits, and may carry monthly fees, so it’s important to weigh the benefits against the potential costs.[6]

- Check for employer match opportunities: 401(k) retirement accounts are a good example. You’re eligible to contribute up to $20,500 to your 401(k) in a single year as of 2022 and an additional catch up contribution of $6,500 more, for those 50 and older. Many large employers might include a percentage match, such as 50 cents on the dollar up to 6% of your annual salary.[7] That’s free money.

- Create a sinking fund for planned expenses: Some people use sinking funds to set aside money for paying off future debt. But you can use them for any targeted, cost-specific expense as well: things like a wedding, down payment on a home, a vacation or property taxes. Just set money aside in a dedicated savings account until you’ve got enough to cover your expenses.

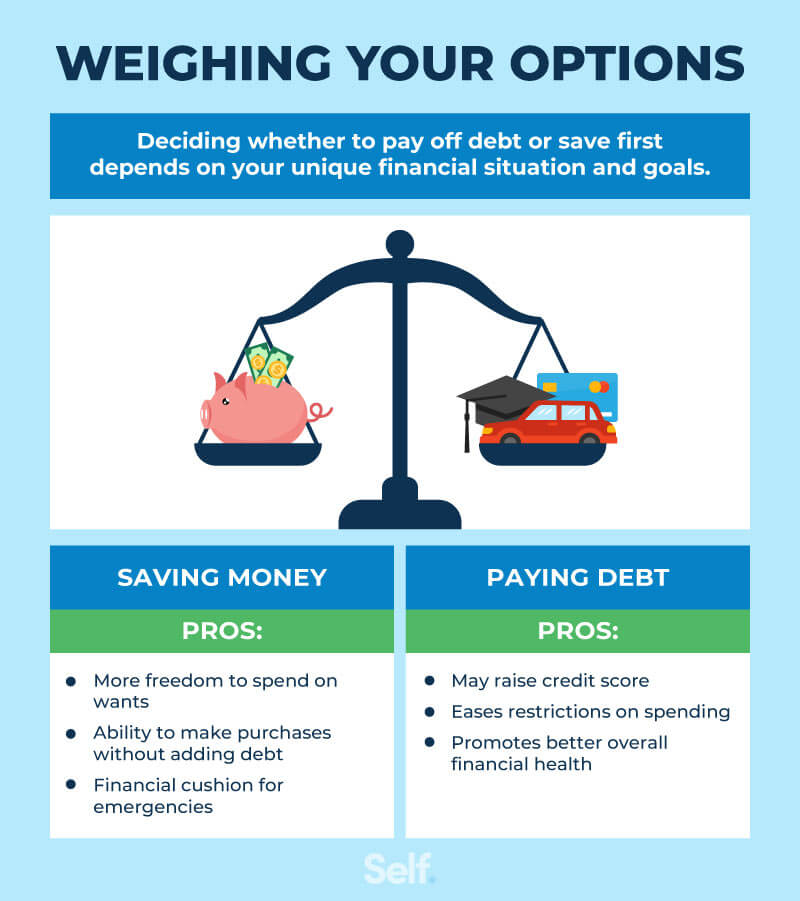

Pros of paying off debt

- Raises credit score: Paying off credit cards can decrease your credit utilization ratio: your total credit limit divided by your overall debt. If you have $500 in debt on a $1,000 credit limit, that’s a 50% credit utilization ratio, and credit utilization is the second-biggest factor in determining your FICO® Score, right behind your payment history. Experts consider anything below 30% to be a good credit utilization ratio.

- Better interest rates: The better your payment history and the lower your credit utilization, the better your credit score is likely to be. As you build credit, this can pay off in the form of lower interest rates when lenders assess your creditworthiness.

- More ability to save for your future: The less debt you have, the more money you’ll be able to put toward savings. Whatever money you were using to make debt payments can be put toward your savings once those debts are paid.

Pros of saving money

- Have extra cash for emergencies: You never know what kind of emergency you may face: a $200 plumbing charge or a $1,000 car repair bill. The more money you have set aside, the better you’ll be able to weather the more significant storms that come your way.

- Work towards long-term goals (e.g., homeownership, new car): Savings aren’t just for emergencies; they can be used to achieve long-term goals such as making a down payment on a house, buying a car, going on vacation or planning a wedding.

- Prepare for retirement: Saving for retirement or putting money toward investments (or both, as with an individual retirement account or IRA) can increase your financial security down the road.

Should I use my savings to pay off debt?

Using your savings to pay off debt can be risky, especially if you don’t have an adequate emergency fund to meet unexpected expenses. Before you dip into your savings, it's worthwhile to look for expenses you might be able to trim to make ends meet.

Choose the strategy that works best for you

Even when money is tight, paying down debt and putting aside money for savings isn’t impossible. You just need to find a strategy that works for you and be patient. Debt usually doesn’t disappear overnight and building up savings is a process, too, but you can make progress toward your goals if you find a strategy that works for your financial situation and stick to it.

By taking stock of some tips presented here and applying them to your financial situation, you can empower yourself to take control of your finances and prepare for a more secure, more satisfying future.

Sources

- America Saves. “54 Ways to Save Money,” https://americasaves.org/resource-center/insights/54-ways-to-save-money/. Accessed July 12, 2022.

- Forbes. “Consumers Worry Most About Losing Their Jobs During A Recession – But Few Do Anything About It,” https://www.forbes.com/sites/janetberryjohnson/2019/11/20/consumers-worry-most-about-losing-their-jobs-during-a-recession--but-few-do-anything-about-it/?sh=50956a2910e6. Accessed March 2, 2022.

- Federal Trade Commission. “What To Know About Payday and Car Title Loans,” https://www.consumer.ftc.gov/articles/what-know-about-payday-and-car-title-loans. Accessed March 2, 2022.

- CNBC. “Payday loans can have interest rates over 600%—here’s the typical rate in every U.S. state,” https://www.cnbc.com/2021/02/16/map-shows-typical-payday-loan-rate-in-each-state.html. Accessed March 2, 2022.

- Experian. “Which Debts Should I Pay Off First?” https://www.experian.com/blogs/ask-experian/what-debts-should-i-pay-off-first/. Accessed March 2, 2022.

- Forbes. “What Is A High-Yield Savings Account?” https://www.forbes.com/advisor/banking/what-is-a-high-yield-savings-account/. Accessed March 2, 2022.

- Investopedia. “How 401(k) Matching Works,” https://www.investopedia.com/articles/personal-finance/112315/how-401k-matching-works.asp. Accessed March 2, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).