How to Pay Off Debt in Collections

Published on: 06/07/2022

If you’re struggling with debt collectors, paying what you owe and getting out of debt might seem like an uphill battle.

But how does your debt end up in collections in the first place? If you don’t make payments, a lender typically sells the past-due debt to a collection agency in what’s known as a charge-off. This could happen 120 or 180 days after your last payment, depending on the type of credit account involved.

At this point, you may start getting phone calls, emails, or even text messages from the debt collector, who now owns your debt, demanding payment.

Under the Fair Debt Collection Practices Act, there are protections in place to shield consumers from harassment and unfair pressure tactics some bill collectors may use.[1] But even with those protections in place, the situation still can be anxiety-inducing.

This article will address some of the steps you can take and the questions you may have about how you can pay off a debt in collections.

1. Verify that the debt is yours

A debt collector is required by law to supply you with a debt validation letter within five days of contacting you regarding a debt.[2] This letter should contain the name of the original creditor, the amount of the debt, and your right to obtain verification of the debt within a 30-day period; if you fail to do so, the debt may be presumed valid.[3]

Mistakes can be made in assigning debt. Even worse, scammers may pose as debt collectors. You should always request a debt verification letter to provide proof that the debt is yours.

How to write a debt verification letter

A debt verification letter is your response to a creditor’s demand for payment, sent within 30 days of when you receive a demand for payment. You can ask for documentation showing you are responsible, including specific information such as the original lender’s contact information and the account number of the original debt.

You can avoid scams by asking for proof of the collection agency’s authority to collect the debt, such as a license number and other information showing that the collector is operating legally in your state. If you do not believe you owe the debt, you can also contact the three major credit bureaus (Equifax, Experian and TransUnion) to dispute it.

It’s also worth noting that if you dispute the debt in writing, the debt collector isn’t allowed to contact you again until they provide written verification of the debt.[4]

Statutes of limitations on debt collection

If a collection agency is trying to collect an old debt that falls outside the statute of limitations, you may not have to pay it. This will depend on factors such as the laws in your state, the type of debt you have, and your ability to make your case in court.[5] Statutes of limitations for open-ended accounts like credit cards typically range from three to six years depending on the state, but can be as long as 10 years.[6]

The clock on how long a collector can seek payment usually begins to run after you miss a payment.[7] However, if you make a partial payment, it could nullify the original statute of limitations and restart the clock.[5]

2. Calculate an affordable monthly payment

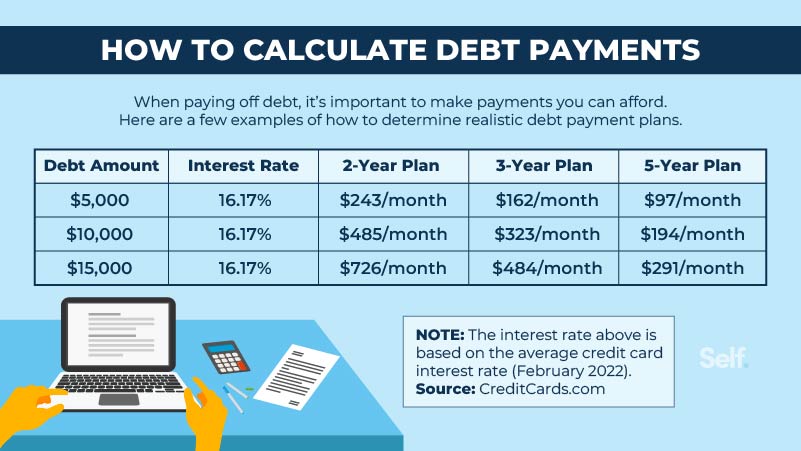

Debt collectors will typically work with you on a payment plan if you can’t repay your debt in a lump sum. First, determine how much you can pay per month. Then, calculate how long it will take to pay off your debt at that monthly rate. Make sure to factor in both principal and interest. There are online debt repayment calculators that can help you.

Here are a few examples of how long it would take to pay off $5,000, $10,000, and $15,000 debts with different monthly payments.

If you’re faced with several debts you’re trying to repay, one course of action may be to contact a credit counselor. A nonprofit credit counseling service can help you develop a reasonable budget, provide financial workshops, offer advice on handling debt, and help you create a “debt management plan.”[8]

3. Contact the debt collection agency

Once you’ve confirmed the debt is yours and calculated manageable monthly payments, it’s time to contact the collection agency. You may be able to negotiate a settlement or reach a repayment agreement.[4] If you decide to negotiate a repayment plan, keep a record of the conversation with the debt collection agency and get the agreement in writing.

Lump sum vs. installment payment

A lump sum is a payment you make all at once, as opposed to paying in installments. If you decide to negotiate a settlement, you can choose whether you do so with a lump sum or under a payment (installment) plan. A collections agency may be willing to accept less if you pay in a lump sum payment option, but you may not have the money to do so.

4. Make payments until the debt is resolved

Once you’ve established a payment plan, it’s important to make consistent, on-time payments and follow the plan until your debt is fully repaid. Make sure to document your payments and check that they are being reported to the credit bureaus by keeping close tabs on your credit report.

How does the debt collection process work?

The debt collection process works as follows:

Your payment is delinquent: A debt becomes delinquent when payment either:

- Isn’t made by the end of the grace period in the loan agreement or

- Is not made by the due date on the initial billing notice.[9]

Your creditor sells your debt to a debt collection agency: As mentioned above, the original creditor may sell your debt to a collections agency after a period of non-payment, typically 120 or 180 days. Unpaid debts may be purchased by a third party at auction for significantly less than the amount of the debt, because it may not be collected.

What types of debt are sent to collections?

Collections agencies often collect on unpaid loans including credit card debt, student loan debt, personal loan debt, auto loan debt, and so forth.

However, the debt doesn’t have to be associated with a loan. Debt can accrue on unpaid bills such as medical bills, bank fees and overdrafts, utility bills, and fines/fees assessed by government agencies or law enforcement agencies.[10]

Can you negotiate debt collection?

Yes, you can negotiate some debt in collections. It’s a good idea to know your financial situation and be prepared to negotiate before you begin.

Because debt collectors typically pay such a small amount of money to buy debt, you may be able to negotiate for less than what you owe. You will likely want to start with a debt settlement offer that’s less than what you’re willing to pay. If the collection agency refuses, you may still have room to negotiate; if it accepts, you’ll have saved yourself some money.

Another benefit of negotiating debt may be getting the debt collector to stop contacting you. If they believe you’re negotiating in good faith, they likely won’t want to antagonize you in the middle of negotiations.

What happens after you make your final debt payment?

After borrowers make their final debt payment, they can see a change in their credit scores, as compiled by FICO® and VantageScore. FICO* is the system most commonly used by lenders.[11] And debt collection payment falls under your payment history, which accounts for the biggest chunk (35%) of your FICO Score.[12]

Whether and how those scores change can depend on different factors.

*FICO is a registered trademark of the Fair Isaac Corporation in the United States and other countries.

How does debt collection affect your credit score?

If you have collections on your credit reports, you’re likely to have a lower credit score than if you don’t. Credit scores may affect both your chances of approval when applying for a loan and how low an interest rate you can get if you qualify.

Different models of credit scoring treat collections differently. The newest FICO and VantageScore models ignore collections that have a zero balance; as a result, your scores under these models (FICO 9 and VantageScore 3.0 and 4.0) may improve. But they may not improve on older models — used by some mortgage lenders and others — that continue to reflect the presence of paid collections.[12]

How long do collections stay on your credit report?

Collections are similar to other negative marks on your credit report in that they can stay there for as long as seven years after the date you first missed a payment.[13]

How do you remove collections from your credit report?

Collections reports that are accurate will remain on your credit report for up to seven years. There’s no law that says they must be removed if they’re paid. However, if they’re inaccurate, you can dispute collections with the credit bureau and try to have them removed. Inaccurate information can be old debt that hasn’t been removed after seven years, mistakes such as math errors, or information that doesn’t belong to you.

You can also offer to pay the collection agency to remove inaccurate information from your credit report by writing a pay for delete letter. Whether this may work depends on the agency’s willingness to accept your offer.

What are your rights?

If you fail to respond to a debt collector or reach a payment agreement, the collection agency may sue you in court. It’s important to respond to the suit, or the collector could win a default judgment against you. This could lead to wage garnishment or the collector garnishing your bank account or putting a lien on your property.

However, consumers do have some protections under the law against unfair treatment and harassment from debt collectors.

What debt collectors can do

Debt collectors can contact you between 8 a.m. and 9 p.m. They can attempt to do so via phone, email, text message or mail.[7]

What debt collectors cannot do

Collection agencies cannot contact you outside the hours mentioned above unless you agree to it, and they can’t try to reach you at work if you inform them you can’t take calls there.[7]

They can’t threaten or harass you, claim you owe more than your actual debt, publicly reveal your debts, or pretend to be an attorney or government representative. They also can’t attempt to collect additional charges on top of what’s allowed in the original contract.[7]

How the Federal Trade Commission protects consumers

The Federal Trade Commission (FTC) protects consumers from unfair debt collection practices such as those listed above under the Fair Debt Collections Practices Act (FDCPA). Complaints about debt collectors concerning threats, harassment, misrepresentation, or other violations can be made to the FTC, Consumer Financial Protection Bureau, or your state attorney general.[7]

Debt collectors found to have violated the act can also be sued in state or federal court. If you choose to take legal action, you’ll need to file your lawsuit within a year of the time the debt collector violated the law. You can sue for lost wages or medical bills incurred as a result of the debt collector’s actions, and the judge may still award you as much as $1,000 even if you can’t prove damages.[7]

It’s important to remember, however, that the illegal actions of a debt collector may not absolve you of the debt itself: You may still owe the money.[7]

Make debt repayment a priority

It’s never a good idea to ignore debt. It can lead to phone calls from collection agencies, lawsuits and even garnished wages. Even if you don’t experience any of those outcomes, the more missed payments you have, the worse it may look on your credit history, and the more it can affect your credit score.

By paying down debt, you can start to build your credit. Knowing your options may be the first step toward getting debt collectors off your back, improving your financial situation, and pointing yourself toward a brighter future.

Sources

- Federal Trade Commission. “Fair Debt Collection Practices Act,” https://www.ftc.gov/enforcement/rules/rulemaking-regulatory-reform-proceedings/fair-debt-collection-practices-act-text. Accessed February 20, 2022.

- Cornell Law School. “15 U.S. Code § 1692g - Validation of debts,” https://www.law.cornell.edu/uscode/text/15/1692g. Accessed February 20, 2022.

- Forbes. “Using Debt Verification And Debt Validation Letters To Respond To Collectors,” https://www.forbes.com/advisor/debt-relief/using-debt-verification-debt-validation-letters. Accessed February 20, 2022.

- Consumer Financial Protection Bureau. “What is the best way to negotiate a settlement with a debt collector?” https://www.consumerfinance.gov/ask-cfpb/what-is-the-best-way-to-negotiate-a-settlement-with-a-debt-collector-en-1447/. Accessed February 20, 2022.

- Consumer Financial Protection Bureau. “What is a statute of limitations on a debt?” https://www.consumerfinance.gov/ask-cfpb/what-is-a-statute-of-limitations-on-a-debt-en-1389/. Accessed February 20, 2022.

- Time. “State Statutes of Limitation for Credit Card Debt,” https://time.com/nextadvisor/credit-cards/credit-card-state-statutes-of-limitation/. Accessed February 20, 2022.

- Federal Trade Commission. “Debt Collection FAQs,” https://www.consumer.ftc.gov/articles/debt-collection-faqs. Accessed February 20, 2022.

- Consumer Financial Protection Bureau. “What is credit counseling?” https://www.consumerfinance.gov/ask-cfpb/what-is-credit-counseling-en-1451/. Accessed February 20, 2022.

- Treasury. “Delinquent Debt Collection,” https://www.fiscal.treasury.gov/files/dms/chapter6.pdf. Accessed February 20, 2022.

- Experian. “What Types of Debt Can Go to Collections?” https://www.experian.com/blogs/ask-experian/what-type-of-debt-can-go-to-collections/. Accessed February 20, 2022.

- MyFICO. “FICO® Advanced,” https://www.myfico.com/products/ultimate-three-bureau-credit-report. Accessed February 20, 2022.

- Experian. “Can Paying off Collections Raise Your Credit Score?” https://www.experian.com/blogs/ask-experian/can-paying-off-collections-raise-your-credit-score/. Accessed February 20, 2022.

- Equifax. “Collection Accounts and Your Credit Scores,” https://www.equifax.com/personal/education/credit/report/collection-accounts/. Accessed February 20, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).