Do Student Loans Affect Your Credit Score?

Published on: 03/25/2022

So, do student loans affect your credit score? Yes, they can. This type of installment loan affects your credit score the same way other loans do: Making your payments on time will help your credit score, but if you are late or have missed payments, it may hurt your score.

Your payment history is the most important factor in determining your credit score. It counts for 35% of your credit score under the formula used by Fair Isaac Corporation, or FICO®, the most widely used credit scoring system.[1]

Repaying student loans may be a good way to build credit. Since a student loan is often the first loan a person takes out, it may be one of the first loans to appear in your credit history. This is important because your credit history accounts for 15% of your FICO score, and as you take on other types of credit, it may help your credit mix (10% of your score) as well.

This article will explain how student loans affect your credit, what could be your best options for repaying them, and how your credit affects college students’ loan applications.

How can student loans help your credit score?

Whenever you take out a new loan, get approved for a credit card, or open a new line of credit, it may appear on your credit report. Your loan and the monthly payments you make then become part of your credit history. Credit reports are compiled by three major credit bureaus:

Your credit score is calculated based on the information in your credit report.[2]

A student loan borrower may be able to use their loans to improve their payment history, credit mix, and length of credit history.

Improve payment history

Making on-time payments is the most important of five major factors in determining your credit score, accounting for more than one-third (35%) of your score, as calculated by FICO.[3] While the VantageScore 4.0 model weighs payment history considerably at 41%.[4] So, regardless of which system a lender uses in determining your creditworthiness, making on-time payments can go a long way toward getting loans approved and obtaining lower interest rates in the future.[5]

Diversify your credit mix

A student loan or education loan can also add diversity to your credit mix, which accounts for 10% of your FICO score and is even more important under the VantageScore system.[3] VantageScore ranks your credit mix and experience as the second-most important factor, at 20%, in determining your credit score.[4]

If you add a student loan to a credit history that includes other types of debt like auto loans, personal loans, and credit card accounts, then you would likely improve your credit mix and, potentially, your credit score.[4]

Lengthen your credit history

Your length of credit history accounts for 15% of your FICO score.[3] Typically, you take out a student loan at a relatively young age and pay it off over many years. By regularly making your payments on time, you’ll show the credit bureaus and lenders that you are financially responsible when it comes to managing any student loan debt.

How can student loans hurt your credit score?

If you miss a payment or are late, that information may be reported to the credit bureaus and become part of your credit record. The impact can be different depending on if you have a federal or private loan.

Lenders may report private loan payments that are more than 30 days late. Federal loan lenders wait three times as long as private lenders—90 days—before reporting a late payment.[6]

Impair payment history

The more payments you miss, the more it may affect your credit score. Negative marks such as reported missed payments stay in your credit file for up to seven years.[7] This works the same way for a student loan payment as it does for any other loan payment.

Forgetting a single payment may not impact your credit score

Temporarily forgetting a payment may not hurt your credit as long as you make that payment before it’s marked as a missed payment.[8] That will happen if you’re more than 30 days late on a private loan or more than 90 days late on a federal loan.[6]

That doesn’t mean it’s a good idea to be late because a lender can still charge you a late fee if your payment is a day past due.

Missing multiple payments will hurt your credit score

If you miss a payment, it may be reported as a delinquency and affect your credit score. Each missed payment may hurt your credit score, and a federal loan may go into default if you fail to make any payments for 270 days. If you have a Federal Perkins loans, your servicer may consider you in default if you do not make a payment by your due date. So be sure to understand your options based on the type of Federal loan you have.[6] So, what happens if you default on student loans? Not only may that hurt your credit score even more, but it also has other consequences, as the Department of Education warns.

For one thing, your entire balance, including any interest you owe, may come due immediately. You may also lose eligibility for any future student aid and may not be able to receive a deferment or forbearance on a defaulted loan. In addition, your tax refunds and federal benefits may be withheld and your wages may be garnished to help pay for the defaulted loan.[6]

Will refinancing student loans impact your credit score?

Student loan refinancing may have minimal impact on your credit score as long as you don’t apply for multiple loans over a long period of time and you continue to make your payments.

Try to apply for loans within a 14 day period. Each time you apply for credit, it counts as a hard inquiry, which can take a few points off your credit score.[9] (Hard inquiries, or new credit, count for 10% of your FICO score.) However, multiple applications for the same kind of loan in a short period will only count as one hard inquiry.

While you might think using a credit card for student loan refinancing might also help your credit score by improving your credit mix, it may not be in your best interest to do so. Many student loans come with lower interest rates than credit cards offer, and if you convert your federal student loan to credit card debt, then you may lose the benefits that come with a federal loan, such as flexible repayment plans and student loan forgiveness.[10]

It is also important to consider how putting your loan on a credit card would affect your credit utilization ratio: the amount of total debt on your credit cards compared to their combined credit limit. Experts recommend keeping that amount below 30%.[11]

Before deciding to refinance, it is suggested that you evaluate your repayment options with your loan servicer, especially if your loan is federally funded. They have many programs that are flexible and could address your current financial circumstances.

Student loan repayment options

If you have a federal student loan, in some cases, payments aren't outstanding until after you graduate or leave school, your enrollment status changes, or drops down to below half-time. However, private student loans typically require you to start making payments while you’re in school.

The following are some student loan payment options to consider.

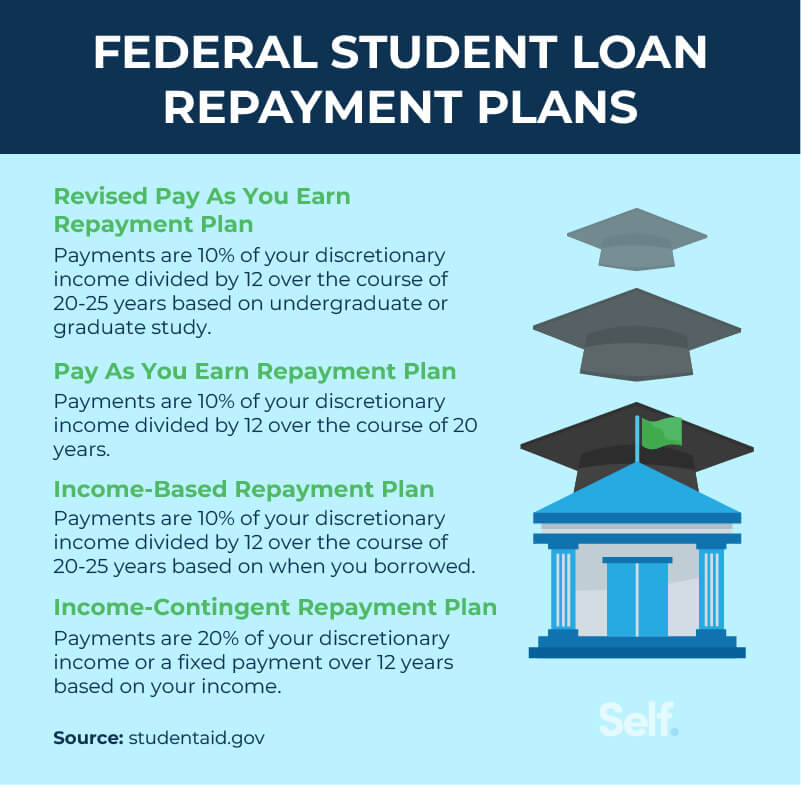

Federal student loan

The Department of Education offers several income-driven replacement plans. There is no fee to apply, and the Department of education has many tools to help you navigate the process to make it easier to apply. See this site for details and to fill out a request.[12]

Revised Pay As You Earn Repayment Plan: Payments are 10% of your discretionary income divided by 12 to get to a monthly payment. The duration of the repayment plans are 20 years for loans received for undergraduate study, and 25 years for loans for graduate or professional study.

Pay As You Earn Repayment Plan: Payments are generally 10% of discretionary income divided by 12 for your monthly payment. The amount of your monthly payment is determined by your adjusted gross income, size of your family, and total eligible federal student loan balance. PAYE loans are repaid over 20 years.

Income-Based Repayment Plan: IBR plans require payments of 10% of your discretionary income and are repayable over 20 years if you borrowed on or after July 1, 2014. If you became a first-time borrower before that, then the rate is 15% and the repayment period is 25 years.

Income-Contingent Repayment Plan: Under this plan, payments are spread over 25 years. You pay the lesser of 20% of your discretionary income or whatever you would pay under a repayment plan with a fixed payment over 12 years, adjusted to your income.[13]

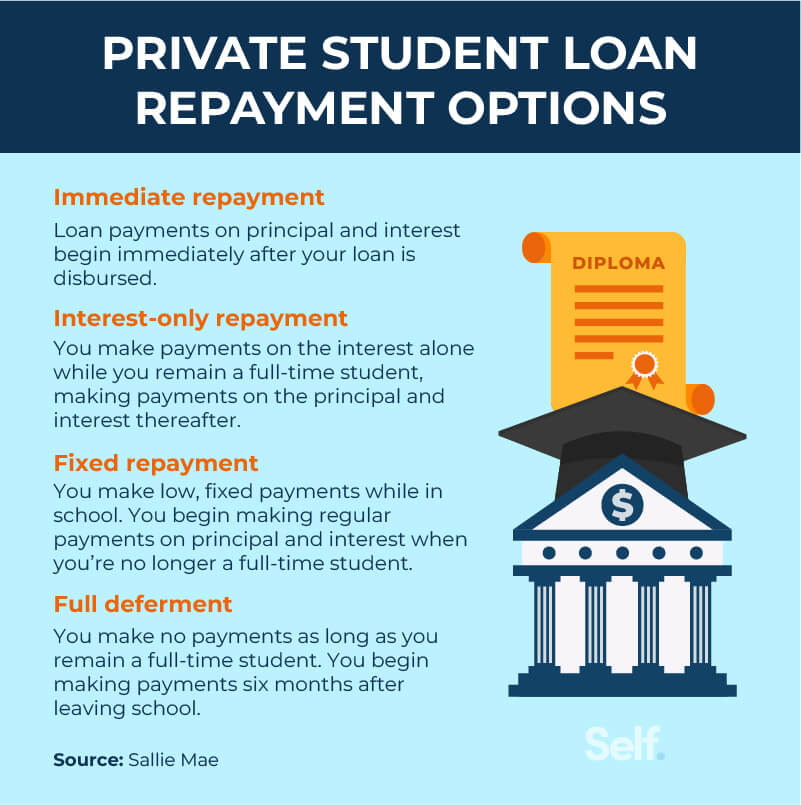

Private student loan

A private student loan may have less flexible repayment options and interest may begin accruing as soon as you take out the loan. Here are some options to be aware of.[14]

Immediate repayment: Loan payments on principal and interest begin immediately after your loan is disbursed. Because you’re making payments while you’re in school, you’ll save money on interest and pay the loan off faster.

Interest-only repayment: You make payments on the interest alone while you remain a full-time student, and start making payments on the principal and interest thereafter.

Fixed repayment: While you’re in school, you make low fixed payments, usually $25 a month. Once you’re no longer a full-time student, you begin making regular payments on principal and interest.

Full deferment: You make no payments as long as you remain a full-time student and begin making payments six months after you leave school. However, interest continues to accrue while your loan is deferred, making it more expensive.[14] Keep in mind some Federal Student Loans may begin to accrue interest as soon as you take out the loan, as well.

Do you need good credit to apply for student loans?

Many federal student loans don’t require you to undergo a credit check, so your credit score isn’t a factor. Direct PLUS loans are an exception: They do require a credit check, but your credit won’t affect your interest rate. All PLUS loans are disbursed at the same rate in a given year.[15]

PLUS Loans are traditionally for eligible parents of undergraduate students and also eligible graduate students may apply on their own. Many private student loans require a co-signer when you apply. As with other private loans, you’ll need to undergo a credit check to see whether you qualify, and if you do, a higher credit score will mean a lower interest rate.[10]

Make student loan payments on time

Student loans can affect credit like any other loan, so it’s important to stay current on your payments. It’s helpful to research different kinds of student loans before you apply, so you’ll know what type of payments are required, how much interest you’ll be paying (and when), and the duration of your loan, as well as what kind of options you have if you have trouble making payments.

On the positive side, if you stay up to date on your payments, then student loans may help you build credit by adding to your credit history and credit mix.

Sources

- MyFico. “What is Payment History?” https://www.myfico.com/credit-education/credit-scores/payment-history. Accessed March 23, 2022.

- Consumer Financial Protection Bureau. “What is the difference between a credit report and a credit score?” https://www.consumerfinance.gov/ask-cfpb/what-is-the-difference-between-a-credit-report-and-a-credit-score-en-2069/. Accessed January 21, 2022.

- MyFico. “What’s in my FICO® Scores?” https://www.myfico.com/credit-education/whats-in-your-credit-score. Accessed March 23, 2022.

- VantageScore. “The Complete Guide to Your VantageScore,” https://vantagescore.com/press_releases/the-complete-guide-to-your-vantagescore/. Accessed March 23, 2022.

- VantageScore. “What is a good credit score and how to get one,” https://vantagescore.com/press_releases/what-is-a-good-credit-score-and-how-to-get-one/. Accessed March 23, 2022.

- Federal Student Aid. “Student Loan Delinquency and Default,” https://studentaid.gov/manage-loans/default. Accessed January 21, 2022.

- Equifax. “How Long Does Information Stay on My Equifax Credit Report?” https://www.equifax.com/personal/education/credit/report/how-long-does-information-stay-on-credit-report/. Accessed March 23, 2022.

- Forbes Advisor. “Missed A Student Loan Payment? Here’s What Could Happen,” https://www.forbes.com/advisor/student-loans/missed-student-loan-payment/. Accessed March 23, 2022.

- MyFico. “Credit Checks: What are credit inquiries and how do they affect your FICO® Score?” https://www.myfico.com/credit-education/credit-reports/credit-checks-and-inquiries. Accessed March 23, 2022.

- Federal Student Aid. “When it comes to paying for college, career school, or graduate school, federal student loans can offer several advantages over private student loans,” https://studentaid.gov/understand-aid/types/loans/federal-vs-private. Accessed January 21, 2022.

- Consumer Financial Protection Bureau. “How do I get and keep a good credit score?” https://www.consumerfinance.gov/ask-cfpb/how-do-i-get-and-keep-a-good-credit-score-en-318/. Accessed January 21, 2022.

- Federal Student Aid. “Income-driven repayment (IDR) plan request,” https://studentaid.gov/app/ibrInstructions.action. Accessed January 21, 2022.

- Federal Student Aid. “If your federal student loan payments are high compared to your income, you may want to repay your loans under an income-driven repayment plan,” https://studentaid.gov/manage-loans/repayment/plans/income-driven. Accessed March 23, 2022.

- Sallie Mae. “Federal vs. Private Student Loan Repayment Options,” https://www.salliemae.com/student-loans/manage-your-private-student-loan/understand-student-loan-payments/explore-loan-repayment-options/. Accessed January 21, 2022.

- Federal Student Aid. “Direct PLUS Loans are federal loans that parents of dependent undergraduate students can use to help pay for college or career school,” https://studentaid.gov/understand-aid/types/loans/plus/parent. Accessed March 23, 2022.

About the author

Jeff Smith is the VP of Marketing at Self Financial. See his profile on LinkedIn https://www.linkedin.com/in/jeffreyfsmith/.

About the reviewer

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program and has taught workshops for nonprofits in NYC.