How Credit Utilization Works

Summary and Key Takeaways

- Credit utilization is essential to your credit score because it indicates how well you manage credit card debt.

- The credit utilization ratio calculates how much you owe by the maximum amount you can borrow. For example, if you have a $2,000 balance and an $8,000 total credit limit, your credit utilization rate is 25%.

- Experts agree that a credit utilization rate of below 30% is ideal.

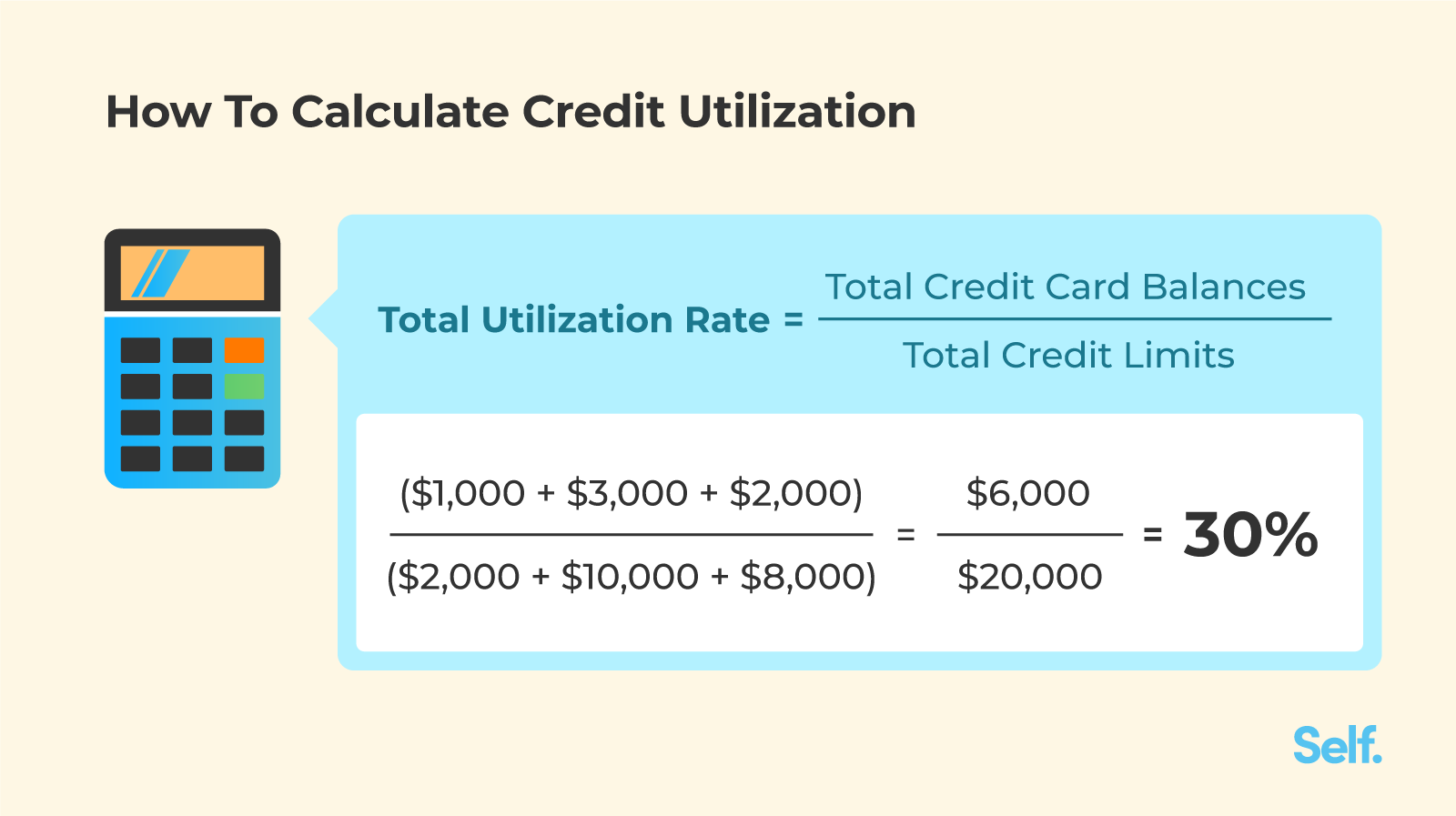

- Add all credit card balances and divide them by the total credit card limit to get the aggregate utilization rate.

- Closing a credit card may increase your utilization rate because your credit utilization is calculated for each card across multiple combined credit cards.

Using credit cards regularly and responsibly can help you learn how to build credit or improve your credit score.

In fact, credit card usage is so important in calculating your credit score that it helps make up 30% of your FICO® credit score.

The way credit scoring models determine how you use your credit cards is by calculating your credit utilization rate, otherwise known as your credit card utilization ratio. The more you know about how credit card utilization works and what to do to keep it at a healthy level, the better this factor in your credit score can help you have a higher credit score.

What is credit utilization?

Simply put, your credit utilization ratio is calculated by dividing how much you owe by the maximum amount you can borrow. It’s determined for each credit card individually, as well as across all of your cards.

For example, let’s say you have three credit cards. Here’s how you would calculate your credit card utilization rate for each:

- Card A: $1,000 balance, $2,000 total credit limit; 50% utilization rate.

- Card B: $3,000 balance, $10,000 total credit limit; 30% utilization rate.

- Card C: $2,000 balance, $8,000 total credit limit; 25% utilization rate.

To get your aggregate utilization rate, you’d add up all three credit card balances and divide them by the total of your credit card limit, or $6,000 divided by $20,000 for a rate of 30%.

Your credit utilization is an important factor in your FICO credit score because it's an indicator of how you manage your credit card debt - and your revolving credit accounts - on a regular basis. A low credit card utilization rate shows potential lenders that you're using revolving credit but not necessarily relying on it to get by. High credit utilization can send a different signal.

“High utilization can be a sign that you're overextended financially and less likely to pay your credit obligations as agreed,” says Michelle Black, credit expert and founder of CreditWriter.com.

One thing to keep in mind is that credit utilization rates are not the same as debt-to-income ratios. The latter is an equation used to calculate how much of your monthly gross income goes toward all of your amounts owed and isn’t based on balances or just one type of credit.

“Credit utilization has a huge influence on credit scores, second only to your payment history itself. If your goal is to earn and keep good credit scores, you have to keep an eye on your credit utilization rates,” Black says.

What’s a good credit utilization rate?

Financial experts recommend keeping your credit utilization below 30% at all times, and VantageScore, an alternative credit scoring model to FICO, agrees with that suggestion.[4] According to data by the credit bureau, Experian[1], the average utilization rate for all Americans in 2021 was 25.6%.

With the FICO credit score[2] , however, there is no hard-and-fast rule. There is no threshold where if your utilization exceeds it, you’ll see a big drop in your personal credit score. Instead, FICO recommends keeping your utilization rate as low as possible, even if you have multiple credit cards.

Just avoid a consistent 0% usage rate, if possible, because it could be seen as a sign that you don’t use credit regularly enough. If that’s the case, your credit card account may be closed due to inactivity and your credit score may be negatively impacted by that closure your credit card account may be closed due to inactivity and your credit score may be negatively impacted by that closure.

Want to learn more about FICO vs Vantage scores? We’ve got the resources for you.

How often is my credit utilization calculated?

Your credit card company reports information about your account, including your balance, once a month, typically on your closing statement date. That doesn’t necessarily mean your credit utilization is updated in your credit score once a month, however.

Before we get into timing, it’s important to make the distinction between who calculates your credit utilization. The credit bureaus, including Experian, Equifax, and TransUnion, keep your credit history in the form of credit reports, but they don’t do the actual calculation of your credit score, and neither do lenders.

Rather, it’s the credit scoring companies like FICO and VantageScore that run the numbers. As a side note, not all credit scoring models necessarily give the same weight to credit utilization. Since the FICO(R) score is used by 90% of the top lenders, it’s best to focus on how they consider it when it comes to your credit score.

How often your utilization rate is calculated depends on the service you use to check your overall credit score. Some, for instance, update your credit score with the most recent information once a month, while others may report your credit usage every few months or every week.

So regardless of when your utilization rate is actually updated with the credit bureaus, you may not see it reflected in your credit score until the service you’re using gets the memo that the information has changed.

That said, once the information is updated, you should see your credit score change quickly.

“Finding out your statement closing date is easy. Simply check your statement or give your credit card issuer a call,” says Black.

How closing a credit card can affect your credit utilization

Because your credit utilization is calculated for each card and across your multiple credit cards combined, closing a credit card may increase your utilization rate.

As an example, let’s say you have the same three cards as before, but close Card C. You’ll be left with the following cards:

- Card A: $1,000 balance, $2,000 credit limit; 50% utilization rate.

- Card B: $3,000 balance, $10,000 credit limit; 30% utilization rate.

Now, your new credit utilization will be 33%, which is a slight increase from the 30% figure in the original scenario. That may not have much of an impact on your credit score. But if closing a card with a higher credit limit increases your overall utilization rate by a lot, it could have a negative impact on your score.

As a result, it’s typically better to keep old credit card accounts open unless they charge an annual fee, have a security deposit tied to them, or you’re worried about overspending. By sticking the card in a sock drawer and using it every six months or so to keep it active, you can keep your total available credit higher and avoid causing a spike in your credit utilization.

Learn more about what happens if you close a credit card.

How business credit cards affect your credit utilization

If you have personal and business credit cards, you may be wondering whether your business credit card can affect your personal credit score.

Unfortunately, the answer is yes in some cases. Among the top credit card issuers, both Capital One and Discover report all of your credit card activity from your buisness credit card accounts to the consumer credit bureaus.

That may also be the case with some smaller issuers, including community banks and credit unions. Among the other major issuers, however, your business credit card won’t show up on your personal credit report at all unless you’re delinquent on your account.

If you have a business credit card from a credit card company that does report your card activity to the personal bureaus, use some of our tips below to keep your utilization rate down or consider getting a different card, so you don’t have to worry about overspending on your available credit.

Tips for keeping your credit utilization low

Whether you’re working on building good credit or want to maintain your good credit score, here are four things you can do to maintain a good credit utilization ratio.

1 - Use more than one card

If you’re putting all of your purchases on just one credit card every month, the chances of racking up a high credit card balance are greater than if you spread your spending over more than one card.

Also, if you have multiple rewards credit cards, this strategy can help you maximize the value you get out of your cards. Just be sure to keep an eye on your aggregate utilization rate to avoid going too high.

If you don’t have more than one card, it may not make sense to open another one just for the sake of your total credit utilization. Check out the other tips for more options.

2 - Ask for a credit limit increase

If your card has a low limit, you may be able to get a credit card limit increase if your credit has improved since you first got the credit account. Just keep in mind that asking doesn’t guarantee an increase. Also, some credit cards may charge a fee to process a credit line increase.

3 - Use your cards sparingly

If you’re worried about racking up too high of a credit card balance, it may be worth using your credit cards until you reach a utilization rate you feel comfortable with, then switching to cash or debit cards for the rest of the month.

4 - Time your payments

If you don’t want to switch back and forth between credit, cash and debit, another option is to time your payments to keep your utilization rate low on the day it gets reported by your lender. You can do this by making multiple payments throughout the month or finding out when your credit card issuer reports your account activity and make a payment a day or two beforehand. Keep in mind if you pay multiple times or pay early to lower your credit utilization rate, you are most likely giving up your grace period.

5 - Set up alerts

Sign up to receive notifications over email or text to alert you about your balance. You can decide to be notified once your outstanding balance reaches a certain amount of your credit limit. Once you start receiving these notifications, try to keep your outstanding balance below 30%.

Manage credit usage well

Your total credit utilization is one of the credit score factors you’ll want to know how to manage. As you practice good credit habits and maintain a good credit utilization ratio, your credit score should improve and stay in a good range over time.

__ Sources:__

Experian. “Experian 2020 Consumer Credit Review” https://www.experian.com/blogs/ask-experian/consumer-credit-review/ Accessed March 25, 2021

Experian. “What is a FICO score and why is it is important” https://www.experian.com/blogs/ask-experian/fico-score-what-it-is-and-why-its-important/ Accessed March 25, 2021

U.S News. “Do Business Credit Cards Affect Your Personal Credit?” https://money.usnews.com/credit-cards/articles/do-business-credit-cards-affect-your-personal-credit Accessed October 19, 2022

Equifax. “What are the benefits of knowing your VantageScore 3.0 credit score?” https://www.equifax.com/personal/education/credit/score/benefits-of-knowing-vantagescore/ Accessed October 19, 2022

About the author

Ben Luthi is a personal finance writer who has a degree in finance and was previously a staff writer for NerdWallet and Student Loan Hero.

WRITTEN ON APRIL 9, 2019

Self is a venture-backed startup that helps people build credit and savings.Comments? Questions? Send us a note at hello@self.inc.Disclaimer: Self is not providing financial advice. The content presented does not reflect the view of the Issuing Banks and is presented for general education and informational purposes only. Please consult with a qualified professional for financial advice. See Ben on Linkedin and Twitter.

About the reviewer

Lauren Bringle is an Accredited Financial Counselor® and Content Marketing Manager with Self Financial – a financial technology company with a mission to help people build credit and savings. See Lauren on Linkedin and Twitter.

MORE ON CREDIT:

How do Late Payments Affect Credit?

Do You Have Insufficient Credit History? What it Means and How to Fix It

Payment History and How it Impacts Your Credit