Does Being An Authorized User Affect Your Credit Score?

Published on: 01/18/2023

Becoming an authorized user on a credit account can affect your credit score either positively or negatively. To impact your score at all, credit card companies must report the authorized user’s account to the three major credit bureaus (Experian, Equifax, and TransUnion). The amount of impact will depend on the credit scoring model and many other factors.[1]

If you want to become an authorized user, do so with a cardholder with an older account and who has a record of on-time payments with that card as well a low credit utilization rate (CUR, the total balance divided by the credit limit). If you become an authorized user on an account that has high credit card debt compared to the credit limit or negative information like late payments, it may hurt your own credit score.

In this guide, we describe what authorized user means, how being one can impact your credit score, and how to gain authorized user status on another person’s credit card.

Table of contents

- What is an authorized user?

- How can being an authorized user impact credit?

- How the major credit bureaus view authorized users

- How credit scoring models weigh authorized users

- How to become an authorized user

- Authorized users vs. joint account holders

- Authorized users vs. cosigners

- Building credit habits

What is an authorized user?

An authorized user is someone who has been given permission to use another account holder’s credit card to make purchases, just like the cardholder. However, unlike the cardholder, an authorized user is not legally responsible for making payments. Authorized users typically are family members of cardholders who use their authorized user status as a credit-building opportunity.[2]

When you become an authorized user, the account goes on your credit report as long as the card issuer reports authorized users — some but not all will report a card’s account activity to the credit bureaus for an authorized user. Credit card issuers won’t pull your credit when you are added as an authorized user, and you bear no legal responsibility to make payments on the account even on purchases you make.[3]

Although authorized users may receive their own credit card from the issuer, ultimately the primary cardholder will be responsible for paying all of the payments. The primary cardholder may simply add your name to the account, however, and not give you access to make purchases.[3]

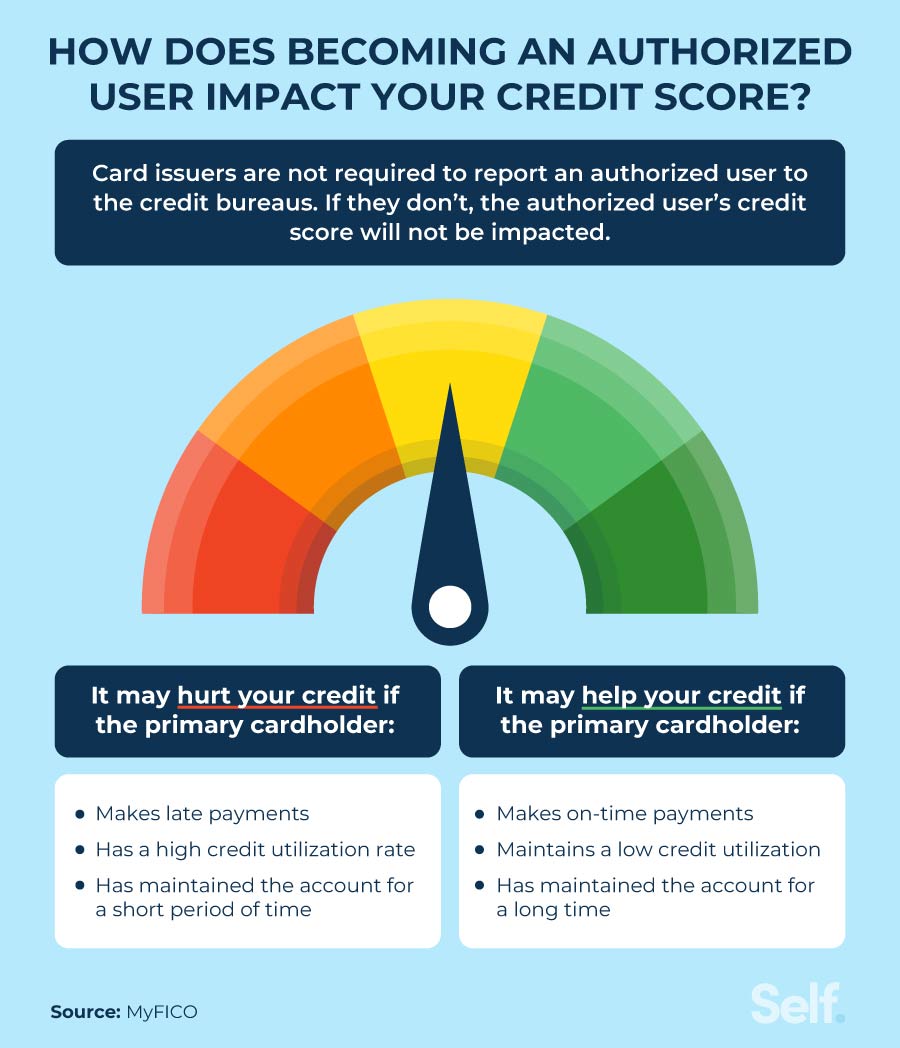

How can being an authorized user impact credit?

Credit card companies will report the user activity of the cardholder to the three major credit bureaus — however, they will not always report this activity to the authorized user’s credit file.

You may need to contact the credit provider yourself to find out if they report authorized users if you want the benefit of someone else’s good standing to impact your credit score. However, if the card issuer does not report authorized users, your score will not be affected at all even if the primary cardholder has excellent credit. So always verify this information by calling the number on the back of the primary cardholder’s card.[4]

Card issuers have their own policies on how often they report to the credit bureaus, but typically they will provide an update once per month, or at least every 30 to 45 days. If the card issuer reports for authorized users, your own individual credit history determines how much of an impact your authorized user status will have on your credit score.[5]

It may help your credit if the cardholder:

- Makes on-time payments: If the account owner has had a record of on-time payments, it may help your credit score because payment history is one of the biggest factors in a person’s credit score.[6]

- Maintains a low credit utilization rate: Your credit utilization ratio (CUR) is how much credit you’ve used divided by your credit limit. If the account owner has been managing their credit responsibly and has a low credit utilization rate, then this may better the authorized user’s credit score.[7]

- Has a longer account history: The older an account is, the better the impact it will have on a credit score. Creditors like to see older accounts with a proven track record than new accounts with little history.[8]

It may hurt your credit if the cardholder:

- Makes late payments: If the account owner has a history of missed or late payments, then it will negatively affect the authorized user's credit.[2] According to FICO®, your payment history makes up 35% of your FICO® score.[6]

- Has a high credit utilization rate: According to FICO®, your credit utilization impacts your amounts owed, which impacts 30% of your FICO® score.[7] If the account owner has a high credit utilization rate, it may affect the authorized user’s credit score.[9]

- Has a short credit history: Newer accounts don’t have a track record, and therefore creditors don’t favor them as much as older accounts where the cardholder has shown a history of using it responsibly.[8]

Even though you aren’t legally responsible for making payments as an authorized user, you should come to an agreement with the cardholder about repaying purchases you make on the card. If you run up a lot of debt the cardholder can’t pay off, you may put the cardholder at risk for late payments and damage your relationship.

You should also pay attention to how responsible the cardholder is. If you notice the account holder is less financially responsible than you were anticipating, such as missing payments or running up high balances, you might consider asking the cardholder to remove you from the account. Just be aware that differences in how a person handles credit can cause rifts in your relationship.[10]

How the major credit bureaus view authorized users

The different credit bureaus have their own way of viewing authorized users. For example, Experian does not include negative payment history on its credit reports for authorized users.[2] Equifax, however, warns that negative payment history could affect both the account holder and the authorized user on its reports.[1]

How credit scoring models weigh authorized users

Different scoring models may weigh your authorized user status differently, but FICO® and VantageScore® typically include authorized user information into their credit score calculations. The different models don’t weigh the information as strongly as other credit accounts since you are not responsible for the payments.[11]. However, FICO® 8 makes a clear distinction. According to Forbes Advisor, FICO® 8 in particular lessens the impact of your authorized user status on your credit report.[12]

How to become an authorized user

If you’d like to become an authorized user, consider the pros and cons first. The benefits include having access to a cardholder’s credit card and some help building credit if payments are made on time and debt is managed well. The downsides for authorized users is that negative payment history or a high credit utilization ratio (CUR) on the account will be reflected in their credit score, and for the cardholders the drawback is they will be responsible for charges they didn’t make and will have to share the credit limit with another person.[13]

To become an authorized user, take the following steps:

- Ask a primary account holder to add you to their account. First, get permission from the cardholder, as they will need to be the one to add you.

- Contact the credit card issuer to make a request. The primary account holder will then reach out to the credit card issuer and ask that you be added to the account.

- If accepted, check to see if you are listed as their authorized user. Contact the credit card directly with the card information to verify that you have been added as an authorized user.

Just because you are added as an authorized user doesn’t mean you will get your own credit card. Check with the credit card issuer to know its policy.

Keep in mind that there are rules for various types of authorized users:

- New immigrants or international students can opt to become an authorized user, but banks may require a Social Security number or individual tax identification number (ITIN) to verify their identity.[14]

- Teenagers can be added to their parents’ credit card as authorized users to help them get a head start on their credit journey or learn how to handle their personal finances.

- Relatives or partners can be added to their partners’ or family members’ accounts as an authorized user.

In any case, no matter who the primary account holder may be, you will both be sharing a credit limit with that person, so you may need to set boundaries with each other of how much you can use and whether you need to pay for your purchases.

As of September 2022, these are the requirements to apply as an authorized user for the following banks. Primary cardholders can contact the customer service number on the back of their cards to request more information about authorized users.

| Minors allowed? | Age requirement | What is required? | |

|---|---|---|---|

| American Express | Yes | 13 | Full name, date of birth and SSN |

| Capital One | Yes | None | Full name, phone number, date of birth and SSN |

| Chase | Yes | None | Full name, date of birth, contact information and SSN |

| Discover | Yes | 15 | Full name, address, date of birth and SSN |

| US Bank | Yes | None | Full name, address, date of birth and SSN |

| Wells Fargo | Yes | 18 | Full name, address, date of birth and SSN |

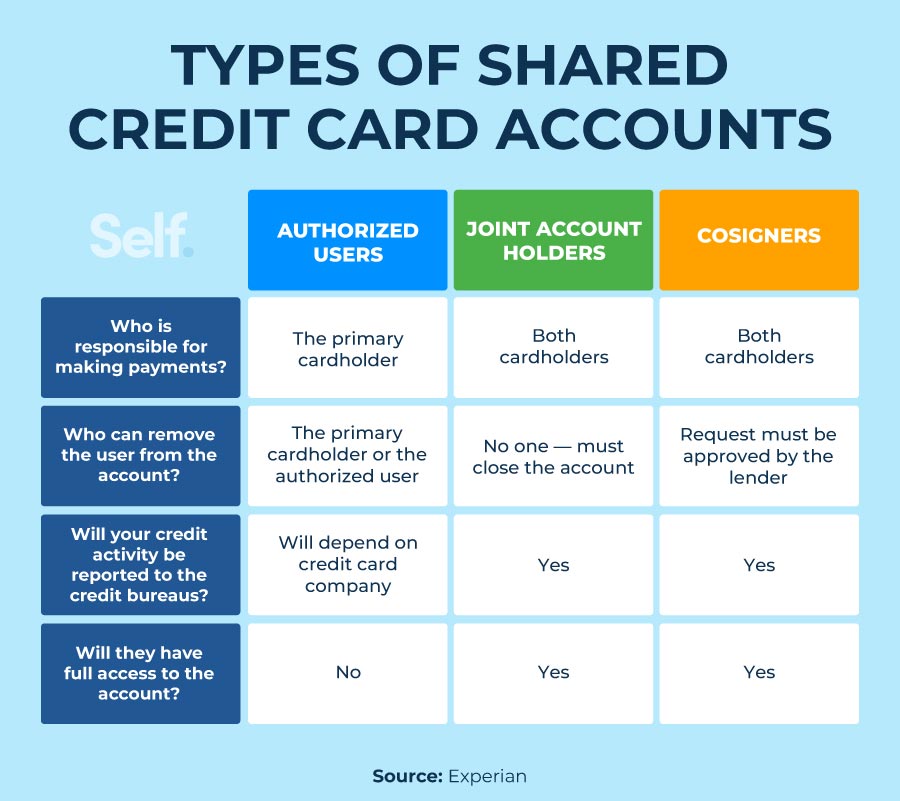

Authorized users vs. joint account holders

With a joint credit card, you both have equal access to the available credit and equal responsibility to pay the card balance. Unlike authorized users who are not responsible for payments or have any power over the credit account, a joint account holder is another primary user on the account. Both joint account holders apply for the account together and are both responsible for paying the balance. Another important distinction between an authorized user and a joint account: Both joint account holders must go through a credit check.[3]

Authorized users vs. cosigners

With a cosigner, both the primary cardholder and the cosigner are responsible for the debt, but cosigners have no access to the credit. You might use a cosigner to strengthen your application for credit since the cosigner shares responsibility for paying the credit card balance. The account will show on both the cardholder and cosigner’s credit reports, which means negative payment history can affect a cosigner’s good credit.[15]

Building credit habits

Whether you have a bad credit score or no credit score, it’s important to start building credit habits for yourself. Here are a few ways to do that:

- Keep your balances low. When you keep your balances low compared to the credit limit, it keeps your credit utilization ratio low.

- Pay your bills on time. Another way to show responsibility is by making payments on time, which gives creditors confidence that you are likely to pay back what you owe.

- Review your credit report regularly. Check your credit report often to ensure that it is accurate and contains no negative marks that are hurting your score. Keep in mind you are legally entitled to one free credit report per year from each credit bureau at www.AnnualCreditReport.com.

- Avoid applying for too many credit accounts. An application for a new credit account will only slightly lower your score temporarily, but a lot of them within a short period of time can add up.

Disclaimer: FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

Sources

- Equifax. "What Is an Authorized User on a Credit Card?" https://www.equifax.com/personal/education/credit-cards/authorized-user-on-a-credit-card. Accessed Sept. 23, 2022.

- Experian. "Credit Card Authorized User: What You Need to Know," https://www.experian.com/blogs/ask-experian/what-is-credit-card-authorized-user. Accessed Sept. 23, 2022.

- Experian. "Authorized User vs. Joint Account Holder: What’s the Difference?" https://www.experian.com/blogs/ask-experian/authorized-user-vs-joint-account-holder-whats-the-difference. Accessed Sept. 23, 2022.

- Forbes. "Credit Card Authorized User: What You Need To Know," https://www.forbes.com/advisor/credit-cards/authorized-user-credit-card. Accessed Sept. 23, 2022.

- Experian. "How Often Is My Credit Score Updated?" https://www.experian.com/blogs/ask-experian/how-often-is-my-credit-score-updated. Accessed Sept. 23, 2022.

- MyFICO. "What is Payment History?" https://www.myfico.com/credit-education/credit-scores/payment-history. Accessed Sept. 23, 2022.

- MyFICO. "What Should My Credit Utilization Ratio Be?" https://www.myfico.com/credit-education/blog/credit-utilization-be. Accessed Sept. 23, 2022.

- MyFICO. "What is the Length of Your Credit History?" https://www.myfico.com/credit-education/credit-scores/length-of-credit-history. Accessed Sept. 23, 2022.

- Forbes. "Does Being an Authorized User Build Credit?" https://www.forbes.com/advisor/credit-cards/will-being-an-authorized-user-help-you-build-credit. Accessed Sept. 23, 2022.

- Experian. "How to Remove an Authorized User From Your Credit Card," https://www.experian.com/blogs/ask-experian/how-to-remove-authorized-user-from-credit-card. Accessed Sept. 23, 2022.

- Experian. "Do Authorized-User Accounts Improve My Credit Score? https://www.experian.com/blogs/ask-experian/authorized-user-accounts-can-factor-in-to-credit-scores/. Accessed Oct 4, 2022.

- FICO. "FICO 8 Credit Score Available at All Three National Credit Reporting Agencies," https://www.fico.com/en/newsroom/fico-8-credit-score-available-all-three-national-credit-reporting-agencies. Accessed Sept. 23, 2022.

- Forbes. "The Pros and Cons of Adding an Authorized User on Your Credit Card Account," https://www.forbes.com/sites/billhardekopf/2021/05/11/the-pros-and-cons-of-adding-an-authorized-user-on-your-credit-card-account/?sh=248f48c54475. Accessed Sept. 23, 2022.

- CNBC. “How can new immigrants to the U.S. build credit? https://www.cnbc.com/select/how-do-new-immigrants-build-credit-in-the-us/. Accessed Oct 4, 2022.

- Experian. "Authorized User vs. Cosigner. What Is the Difference?" https://www.experian.com/blogs/ask-experian/what-is-the-difference-between-an-authorized-user-and-a-cosigner. Accessed Sept. 23, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).