Is a 600 Credit Score Good or Bad?

Published on: 10/30/2022

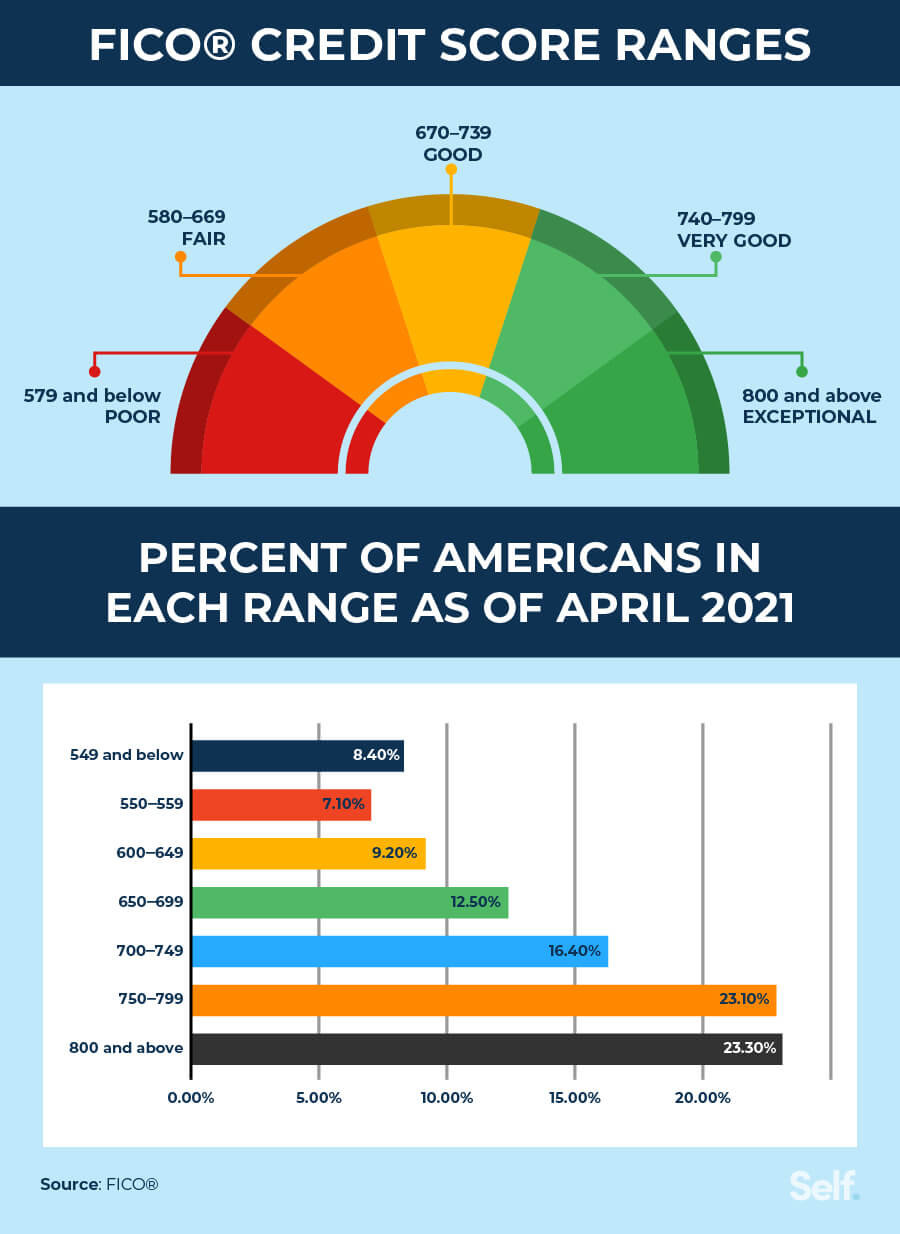

If your FICO® score is 600, or between 580 to 669, FICO® places that score in the fair range, which is below the national average.[1] As the most-used credit scoring model used by over 90% of top lenders when making lending decisions, FICO® calculates your credit score based on several factors and expresses it as a number to indicate your overall creditworthiness. When lenders decide whether to offer you lending credit products, your credit score can inform their decision.[2]

FICO® uses credit score ranges: poor, fair, good, very good and exceptional. You may not receive the most favorable rates or credit products with a fair credit score, but you may have more options than if your score fell within the poor range.

To understand how good or bad a 600 credit score is, this article provides the credit scoring range averages, types of credit products you may get and credit-building tips.

Table of contents

- How bad is a 600 credit score?

- What can you get with a 600 credit score?

- How your credit score is calculated

- How you may improve your credit score

- Check your credit score

How bad is a 600 credit score?

A 600 credit score is seen as a “subprime” credit score, meaning that, in the eyes of potential lenders, a person with that score is less likely to be able to repay their loans.[3] In 2021, the average credit score in America was 716, so a 600 credit score falls far below the average.[4]

FICO® groups credit scores into credit score ranges:

- 579 and below (poor): This range includes high-risk borrowers who are likely to become delinquent on loans, may be rejected by lenders or are required to put down a security deposit or pay a fee when securing utilities or obtaining a credit card.

- 580–669 (fair): Lenders typically consider these borrowers as medium-high risk, meaning they may have more difficulty getting credit and may be subject to higher interest rates.

- 670–739 (good): Scores in this range include medium-risk borrowers who are less likely to become delinquent but still may be subject to higher interest rates.

- 740–799 (very good): Borrowers pose a lower risk to lenders, meaning they’re likely to be approved for credit and receive lower interest rates.

- 800 and above (exceptional): The lowest risk, these borrowers are the least likely to be delinquent, meaning they’re unlikely to face any problems getting credit.

[1]

Many factors contribute to your credit score. Your FICO® credit score may be 600 or lower due to limited credit history, missing or late payments, overlimit or “maxed out” accounts, high balances or multiple hard inquiries. Having a fair or low credit score may cause you to have higher interest rates on credit products, like credit cards and loans.[5]

While most Americans have credit scores above 600, more than a third score below the national average.[4]

What can you get with a 600 credit score?

You may still get credit products with a 600 credit score. However, you’re more likely to get better terms if you have a good credit score or higher (670+).[6] So you may improve your ability to get a new credit card or personal loan with better rates and higher limits by raising your score.

Here are some examples of what you might get with a 600 credit score and how that credit score impacts standard credit products:

- Auto loans: While the credit score requirements for most lenders prefer borrowers with scores in the prime range (661+), you might qualify for a smaller car loan or have to make a bigger down payment. However, not only may this loan be harder to obtain, you may also pay a much higher interest rate.[7]

- Credit cards: You may qualify for a regular, unsecured credit card, but your card issuer may give you a higher interest rate or annual fee.[8] The only option for someone with a bad credit score might be secured credit cards, which are different from traditional cards, requiring you to make an initial deposit into a savings account or certificate of deposit that is used as collateral or security for the card. Additionally student or store cards, which usually have fewer eligibility requirements might also be options.[9]

- Apartment rentals: Typically, landlords consider a score of 620 for the minimum credit score required to rent an apartment, so you may find it difficult to rent if you have poor credit. You may still have options though if you have a cosigner or guarantor or pay a bigger security deposit.[10]

- Mortgages: Most conventional housing loans require a minimum credit score of 620. Some loans, like FHA, USDA and VA, have lower minimums. For instance, FHA loans allow credit scores as low as 500 with an additional down payment, and other qualifications still need to be met to be approved. However, since you may not get the best rate or terms, you may be better off taking time to improve your credit and saving for a down payment before applying for a mortgage.[11]

How your credit score is calculated

FICO® uses five major credit score factors to calculate your score. If you want to understand why you have the score you do, or what you can do to improve it, start by looking at these five factors.

Each makes up a certain percentage of your score based on the FICO® scoring model. The factors include:

- Payment history: This makes up 35% of your credit score and reflects how you have paid your accounts over the length of your credit history.[12] Your payment history for things like loans, credit cards and retail accounts allows lenders to assess how reliably you make payments. Overdue, late and missed payments hurt your score, and bankruptcies and charge-offs are even more damaging.[13]

- Amounts owed: Accounting for 30% of your credit score, your amounts owed reflects the total debt you owe across all accounts, like loans and credit card debt, and how high the balances are on each.[12] If you use too much of your available credit, or reach your credit limit, lenders may view you as higher risk. Keeping your revolving utilization low may help your credit score.[14]

- Length of credit history: Making up 15% of your credit score, your credit history factors in how long your credit accounts have been established, including the ages of your oldest and newest accounts, the average age of all accounts and how long since the accounts have been used.[12] A long-term, consistent credit history will have a positive effect on your FICO score.[15]

- Credit mix: Your mix, which makes up 10% of your credit score, considers all revolving and installment accounts, including credit cards, retail accounts, installment loans and mortgages. While it isn’t necessary for you to have one of every credit product, the score evaluates your ability to manage diverse lines of credit successfully.[16]

- New credit: This factor makes up 10% of your credit score.[12] It takes into consideration the amount of new accounts and inquiries you have. Opening multiple new accounts rapidly or around the same time might not only lower your average account age, but also may make you seem higher-risk to lenders, especially if you don’t have much credit history.

How you may improve your credit score

While there’s no instant fix to improve your credit score, you may be able to increase it over time by implementing these strategies.

Make on-time payments

Since payment history makes up 35% of your credit score, making on-time payments consistently may help build your credit score. Budgeting what you spend each month, or what you can put towards existing debt, may help you avoid spending beyond what you can afford to repay.

Keep your credit utilization low

Credit utilization accounts for the amount of credit you use compared to the amount of credit available to you. Total your credit card balances, and then total your credit limits. If you divide your total balance by your total limit, you come up with a percentage that is your credit utilization ratio.[17]

Experts at FICO® suggest maintaining a credit utilization ratio below 30%, but add that staying close to 10% offers the best chance at adding a positive impact to your credit score.[17] To achieve this ratio, stick to a budget that doesn’t allow for maxing out your cards and spending above your means. Doing so may also help you avoid the additional expense of accumulated interest on high unpaid balances.

Diversify your credit accounts

While you shouldn’t take out loans or lines of credit you don’t need, having a diverse mix of credit and using it responsibly shows lenders that you can manage multiple accounts and accounts of different types.

No matter the account type, make consistent, on-time payments and avoid maxing out your credit limits. Keeping your payment history positive and your credit utilization low may have positive credit-building impacts on your score.

Limit hard inquiries

Opening only the credit accounts you need limits the occurrence of hard inquiries, or requests from lenders to access your credit report.[18] These inquiries can cause a slight drop in your score and will stay on your credit report for two years.[18]

Lenders see these inquiries on your report as a timeline of when you request new credit. Several inquiries close together may make it appear to lenders that you’re experiencing problems with your personal finances, but inquiries of the same type for mortgages and auto loans are seen as one inquiry when done in a short window (such as 14 days for FICO®). Plus, the more new credit accounts you attempt to open, the more hard inquiries you’ll have on your credit report, which may impact your credit score negatively.[19]

Check your credit score

When you want to build a positive credit history, it helps to know where you stand. You can get a free credit report by going to annualcreditreport.com, or visiting the three major credit bureaus, Equifax, Experian and TransUnion where you may pay a small fee (no more than $13.50, by law, for a copy).

Examine your credit report to be sure everything is accurate. Then consider using Self’s credit building products to help get you onto the path of improvement, so you can achieve your financial goals.

Sources

- FICO®. “Credit Scores: How Low Can You Go?” https://www.myfico.com/credit-education/blog/credit-scores-how-low-can-you-go. Accessed July 13, 2022.

- FICO®. “FICO® Scores Are Used By 90% of Top Lenders,” https://www.ficoscore.com/about. Accessed July 13, 2022.

- CNBC. “More than a third of Americans have a credit score that’s considered subprime–here’s what that means,” https://www.cnbc.com/select/what-is-subprime-credit/. Accessed July 19, 2022.

- FICO®. “Average U.S. FICO® Score at 716, Indicating Improvement in Consumer Credit Behaviors Despite Pandemic,” https://www.fico.com/blogs/average-us-ficor-score-716-indicating-improvement-consumer-credit-behaviors-despite-pandemic. Accessed July 13, 2022.

- Capital One. “How Does Your Credit Score Affect Your Interest Rate?” https://www.capitalone.com/learn-grow/money-management/how-credit-score-affects-apr-interest-rate/. Accessed July 13, 2022.

- Experian. “669 Credit Score: Is it Good or Bad?” https://www.experian.com/blogs/ask-experian/credit-education/score-basics/669-credit-score/. Accessed July 25, 2022.

- Investopedia. “What Credit Score Do You Need to Buy a Car?” https://www.investopedia.com/what-credit-score-do-you-need-to-buy-a-car-5181034. Accessed July 13, 2022.

- U.S. News. “Best Unsecured Credit Cards for Fair Credit of July 2022,” https://money.usnews.com/credit-cards/unsecured. Accessed July 25, 2022.

- Experian. “How to Get a Secured Credit Card,” https://www.experian.com/blogs/ask-experian/how-to-get-a-secured-credit-card/. Accessed July 25, 2022.

- Experian. “How to Get an Apartment With Bad Credit,” https://www.experian.com/blogs/ask-experian/how-to-get-apartment-with-bad-credit/#s1. Accessed July 13, 2022.

- Experian. “What Credit Score Do I Need to Buy a House?” https://www.experian.com/blogs/ask-experian/what-credit-score-do-i-need-to-buy-a-house/. Accessed July 13, 2022.

- FICO®. “What’s in my FICO® Scores?” https://www.myfico.com/credit-education/whats-in-your-credit-score. Accessed July 13, 2022.

- FICO®. “What is Payment History?” https://www.myfico.com/credit-education/credit-scores/payment-history. Accessed July 13, 2022.

- FICO®. “What is Amounts Owed?” https://www.myfico.com/credit-education/credit-scores/amount-of-debt. Accessed July 13, 2022.

- FICO®. “What is the Length of Your Credit History?” https://www.myfico.com/credit-education/credit-scores/length-of-credit-history. Accessed July 13, 2022.

- FICO®. “What Does Credit Mix Mean?” https://www.myfico.com/credit-education/credit-scores/credit-mix. Accessed July 13, 2022.

- FICO®. “What Should My Credit Utilization Ratio Be?” https://www.myfico.com/credit-education/blog/credit-utilization-be. Accessed July 15, 2022.

- Equifax. “Understanding Hard Inquiries on Your Credit Report,” https://www.equifax.com/personal/education/credit/report/understanding-hard-inquiries-on-your-credit-report/. Accessed July 13, 2022.

- myFICO. “Credit Checks: What are credit inquiries and how do they affect your FICO® Score?” https://www.myfico.com/credit-education/credit-reports/credit-checks-and-inquiries. Accessed October 14, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).