Personal Finance

The Best Loans for Bad Credit

The Best Loans for Bad CreditNovember 3, 2022

We’ll explain multiple loan options if you need extra cash, but have bad credit. Predatory loans are not your only choice. Read more.

What Is Liquid Net Worth? How to Calculate Yours

What Is Liquid Net Worth? How to Calculate YoursOctober 17, 2022

Liquid net worth is the amount of money you have in cash after subtracting your liabilities from your liquid assets. Read on to see how it works. Read more.

Secured Loans vs. Unsecured Loans: Key Differences & Benefits

Secured Loans vs. Unsecured Loans: Key Differences & BenefitsOctober 17, 2022

Secured and unsecured loans provide different benefits to consumers, but have their drawbacks—here are the key differences between the two loan types. Read more.

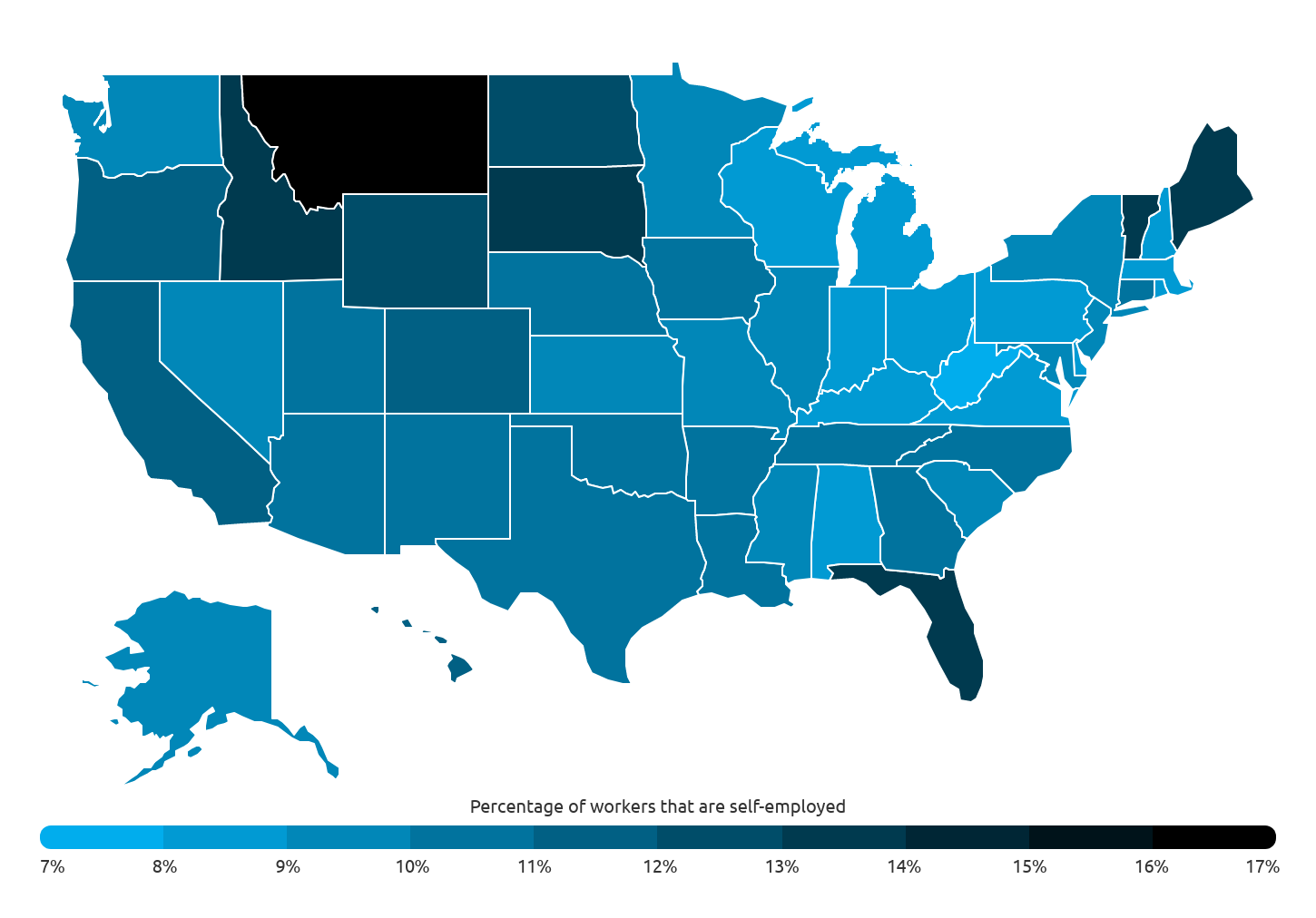

U.S. States and Cities With the Most Self-Employed Workers

U.S. States and Cities With the Most Self-Employed WorkersOctober 13, 2022

The COVID-19 pandemic steered many workers to seek new opportunities, causing self-employment and entrepreneurship to expand and new business applications to reach record levels. Read more.

Preapproved vs. Prequalified Credit Card Offers

Preapproved vs. Prequalified Credit Card OffersOctober 10, 2022

Prequalified or preapproved credit card offers can mean a financial institution has reviewed your creditworthiness and concluded that you are a good fit. Read more.

Can I Get a Loan Without a Bank Account?

Can I Get a Loan Without a Bank Account?October 3, 2022

We explain your options for getting loans without a bank account, how to take advantage of them, and what the process is for getting a loan in this situation. Read more.

What Is A Balance Transfer and How Does It Work?

What Is A Balance Transfer and How Does It Work?October 2, 2022

A balance transfer allows you to move debts to lower interest rate credit card. You may have to pay a balance transfer fee. Read more.

What’s a Good APR for a Credit Card?

What’s a Good APR for a Credit Card?September 26, 2022

An APR is “good” if it’s lower than the national average APR. This article discusses APR, how it is calculated, and what you can do to reduce your APR. Read more.