Does an Overdraft Affect Your Credit Score?

Published on: 05/19/2022

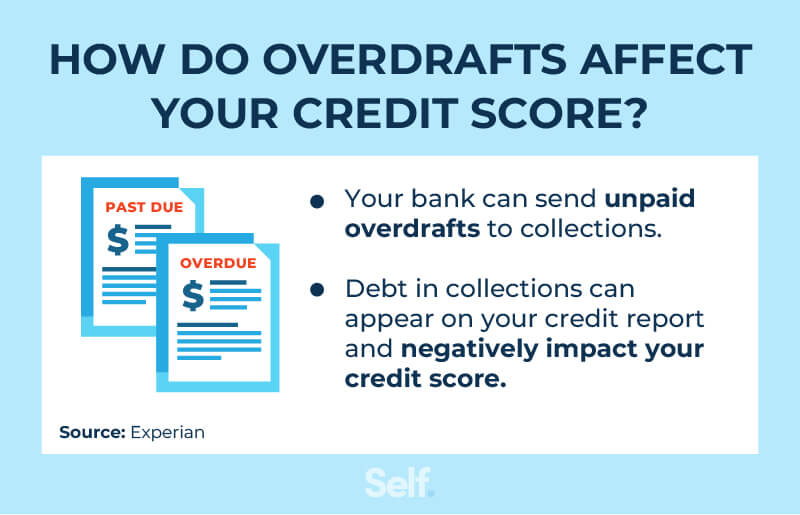

Overdrafts are not reported to credit bureaus, but they could hurt your credit score indirectly if they’re sent to collections. Here’s how that could happen.

How do overdrafts indirectly affect your credit score?

If you overdraw your checking account because you don't have enough money to cover a transaction, the bank may pay what you owe anyway if you have overdraft protection. For this service, the bank may charge you an overdraft fee on top of your negative account balance.

If you consistently overdraft your account, the financial institution may give up on trying to collect and sell your debt to a collection agency in what’s known as a charge-off. That agency may then report what you owe as outstanding debt to the three major credit bureaus, which can hurt your credit.

Collections efforts may begin when a bill is 120 days past due, but can begin sooner. For instance, the National Credit Union Administration (NCUA) guidance states that overdraft balances should “generally be charged off when considered uncollectible, but no later than 60 days from the date first overdrawn.”[1]

Once reported to the credit bureaus, they can be sure to lower your FICO® score. Collections will stay on your credit report as part of your credit history for seven years, although more recent collections hurt your credit more.[2]

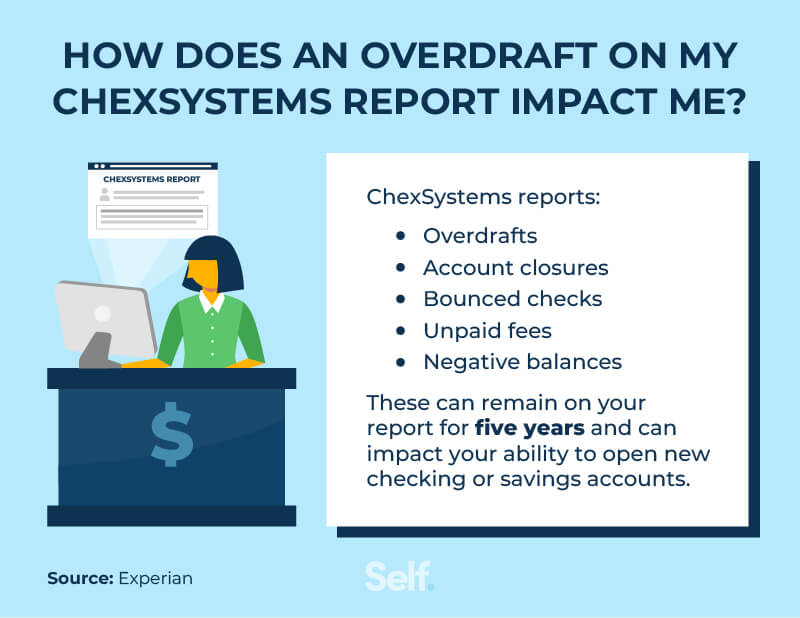

How are overdrafts tracked on your ChexSystems report?

In simplest terms, ChexSystems is to banking what credit bureaus are to credit. Just as information about your debt is reported to the credit bureaus, information about your banking activity is reported to ChexSystems.

ChexSystems doesn’t track your credit card use or loan payments, but it does gather information on:

- Account closures

- Bounced checks

- Overdrafts

- Debit card and ATM use

- Unpaid fees

- Negative balances

ChexSystems reports may not have a negative impact on your credit score, but they could affect whether you’re able to open a new bank account. These reports serve as a resource for banks and credit unions to access when you apply for a new account. If they decide, based on your ChexSystems report, that you’re a high risk for things like bank overdrafts and negative account balances, they may not approve your application.

[3]

Even if this happens, you may still have options. For example, a second-chance bank account might be worth considering if you want to apply with a bank or credit union. Second-chance accounts are designed for people who might get turned down for a traditional account because of their ChexSystems record.

Second-chance accounts can be more convenient than options such as prepaid debit cards and may be less expensive than check-cashing services. However, they can come with additional monthly and debit card setup fees, may require a minimum deposit, and may not come with overdraft protection.

What happens if you don’t pay overdraft debt?

If you find yourself with a negative bank balance and fail to pay the overdrawn amount and fees, your bank could freeze your account or close it and send your debt to collections via a charge-off.[4]

If your account is frozen, you won’t be able to make any further withdrawals, but that doesn’t mean the account is closed. You can typically unfreeze the account by making a deposit that covers the balance you owe.[4]

A closed account, in some cases, can’t be reopened (you’ll likely have to apply for a new one, possibly at a different financial institution).[5] It also means the bank may send your account to collections. This can happen after your account shows a negative balance for 60-120 days.

Should you have overdraft protection?

Overdraft protection is a service many banks and credit unions may offer that allows a customer to overdraw a checking account. This is done so that checks or other transactions can clear even if you don’t have enough money in your account to cover them. Before deciding whether to accept overdraft protection, it’s helpful to know the pros and cons of doing so.

Overdraft protection can shield you from some negative consequences like merchant fees, late payment fees, and fees a payee may charge for a bounced check.

There’s a downside to overdraft protection, though: Financial institutions typically charge a fee (averaging $29.50 at traditional banks and $25.81 at credit unions) for each transaction they have to cover.[6] This can add up quickly.

Even with overdraft protection, banks typically have an overdraft limit: the maximum amount you can overdraw your account. In some cases, you’re limited to four transactions that trigger overdraft fees in a day.[7]

If you want overdraft protection, you will likely need to actively opt in when you open your account or at some later date.

If you’ve incurred an overdraft fee and have a positive payment history, you can try to get your overdraft fees reversed by contacting your bank.

Tips to avoid overdrawing your account

The best way to avoid overdrawing your account may be to opt-in for overdraft protection. Here are some other ways you may reduce your chances of getting into trouble:

- Monitor your account. Sign up for your financial institution’s banking app so you can check your balance and transactions frequently.

- Stick to a budget. The more carefully you budget your spending, the more you’ll be aware of where your money is going, and the less likely you’ll be to outspend what’s in your account.

- Link to your savings. This way, if you drop below zero on your checking account, money will automatically be taken from your savings account to cover the balance owed. You may also be able to link to your credit card in a similar way.[8]

- Sign up for alerts. Some banks will alert you via email or text message if your checking account balance dips below a certain level.

Final thoughts

Opening a bank account is an important financial decision. You may have a variety of financial products to choose from, and you’ll want to select the one that works best for you.

If you choose an account with overdraft protection, it’s helpful to remember a few things:

- Overdrafts and the fees that go with them can add up.

- If you neglect repayment of negative balances and fees, they can go to collection agencies that report to credit bureaus.

- If your credit score falls as a result, you may have difficulty getting good interest rates from credit card companies and other lenders/creditors.

Fortunately, there’s plenty you can do to keep your account balances above zero and your credit score up. If you’re unsure of where you stand, you can ask for a free credit score and take steps toward rebuilding your credit if needed.

Disclosure: FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

Sources

- National Association of Federally-Insured Credit Unions. “Resolving Negative Accounts: Is It 45 or 60 Days?” https://www.nafcu.org/compliance-blog/resolving-negative-accounts-it-45-or-60-days. Accessed April 4, 2022.

- MyFICO. “Collections - How to Manage Them and What They Do to Your Credit,” https://www.myfico.com/credit-education/faq/negative-reasons/should-i-pay-my-collections. Accessed February 16, 2022.

- Experian. “What Is ChexSystems?” https://www.experian.com/blogs/ask-experian/what-is-chexsystems/. Accessed February 16, 2022.

- Sapling. “If a Bank Account Is Sent to Collections, Can It Be Reversed?” https://www.sapling.com/7996328/bank-sent-collections-can-reversed. Accessed May 17, 2022.

- Business Insider. “What to do if a bank closed your account and how to maintain your new one so it won't happen again,” https://www.businessinsider.com/personal-finance/what-to-do-if-bank-closed-your-account#:~:text. Accessed February 16, 2022.

- Forbes. “Understanding Checking Account Overdraft Protection And Fees,” https://www.forbes.com/advisor/banking/understanding-checking-account-overdraft-protection-and-fees/. Accessed February 16, 2022.

- CNBC. “What is overdraft protection and how does it work?” https://www.cnbc.com/select/what-is-overdraft-protection-and-how-does-it-work/. Accessed April 4, 2022.

- Consumer Financial Protection Bureau. “Understanding the Overdraft ‘Opt-in’ Choice,” https://www.consumerfinance.gov/about-us/blog/understanding-overdraft-opt-choice/. Accessed February 16, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.